Question: Save Answer Question 15 2 points The general assembly of the ABC Public Shareholding Company decided to distribute the net profit of the company JD

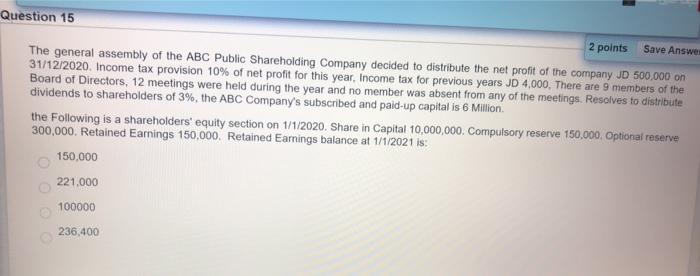

Save Answer Question 15 2 points The general assembly of the ABC Public Shareholding Company decided to distribute the net profit of the company JD 500,000 on 31/12/2020. Income tax provision 10% of net profit for this year, income tax for previous years JD 4,000. There are 9 members of the Board of Directors, 12 meetings were held during the year and no member was absent from any of the meetings. Resolves to distribute dividends to shareholders of 3%, the ABC Company's subscribed and paid-up capital is 6 Million the Following is a shareholders' equity section on 1/1/2020. Share in Capital 10,000,000. Compulsory reserve 150,000. Optional reserve 300,000. Retained Earnings 150,000. Retained Earnings balance at 1/1/2021 is: 150,000 221.000 100000 236,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts