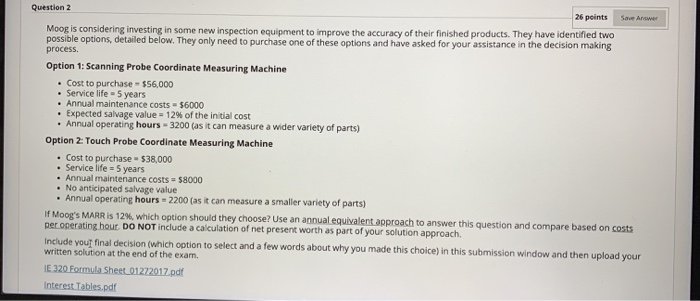

Question: Save Answer Question 2 26 points Moog is considering investing in some new inspection equipment to improve the accuracy of their finished products. They have

Save Answer Question 2 26 points Moog is considering investing in some new inspection equipment to improve the accuracy of their finished products. They have identified two possible options, detailed below. They only need to purchase one of these options and have asked for your assistance in the decision making process. Option 1: Scanning Probe Coordinate Measuring Machine Cost to purchase - $56,000 Service life. 5 years Annual maintenance costs $6000 Expected salvage value = 12% of the initial cost Annual operating hours - 3200 (as it can measure a wider variety of parts) Option 2:Touch Probe Coordinate Measuring Machine Cost to purchase - $38,000 Service life. 5 years Annual maintenance costs = 58000 No anticipated salvage value Annual operating hours - 2200 (as it can measure a smaller variety of parts) If Moog's MARR is 12%, which option should they choose? Use an annual equivalent approach to answer this question and compare based on costs per operating hour DO NOT include a calculation of net present worth as part of your solution approach Include you final decision (which option to select and a few words about why you made this choice in this submission window and then upload your written solution at the end of the exam. E 320 Formula Sheet_01272017 pdf Interest Tables.pdf

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts