Question: Save Answer QUESTION 7 10 points Assume a machine costs $388,000 and lasts four years before it is replaced. The operating cost is $37,500 a

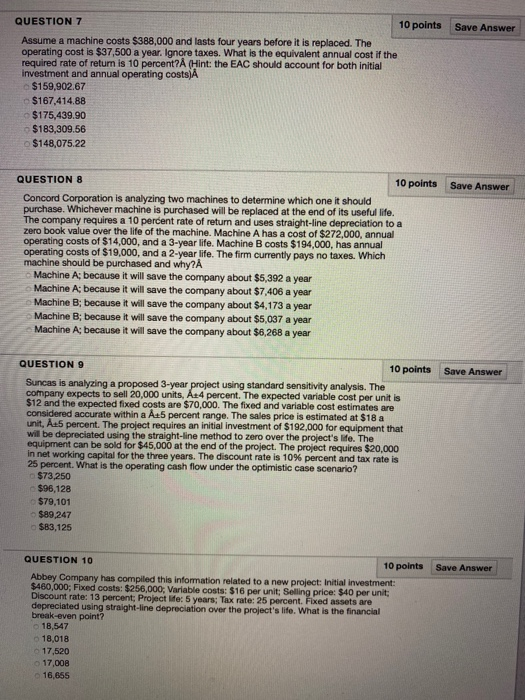

Save Answer QUESTION 7 10 points Assume a machine costs $388,000 and lasts four years before it is replaced. The operating cost is $37,500 a year. Ignore taxes. What is the equivalent annual cost if the required rate of return is 10 percent? (Hint: the EAC should account for both initial investment and annual operating costs)A $159,902.67 $167,414.88 $175,439.90 $183,309.56 $148,075.22 Save Answer QUESTION 8 10 points Concord Corporation is analyzing two machines to determine which one it should purchase. Whichever machine is purchased will be replaced at the end of its useful life. The company requires a 10 percent rate of return and uses straight-line depreciation to a zero book value over the life of the machine. Machine A has a cost of $272,000, annual operating costs of $14,000, and a 3-year life. Machine B costs $194,000, has annual operating costs of $19,000, and a 2-year life. The firm currently pays no taxes. Which machine should be purchased and why? Machine A; because it will save the company about $5,392 a year Machine A: because it will save the company about $7,406 a year Machine B; because it will save the company about $4,173 a year Machine B; because it will save the company about $5,037 a year Machine A: because it will save the company about $6,268 a year QUESTION 9 10 points Save Answer Suncas is analyzing a proposed 3-year project using standard sensitivity analysis. The company expects to sell 20,000 units, A-4 percent. The expected variable cost per unit is $12 and the expected fixed costs are $70,000. The fixed and variable cost estimates are considered accurate within a 5 percent range. The sales price is estimated at $18 a unit, Au5 percent. The project requires an initial investment of $192,000 for equipment that will be depreciated using the straight-line method to ver the project's life. The equipment can be sold for $45,000 at the end of the project. The project requires $20,000 in net working capital for the three years. The discount rate is 10% percent and tax rate is 25 percent. What is the operating cash flow under the optimistic case scenario? $73,250 $96,128 $79,101 $89,247 $83,125 Save Answer QUESTION 10 10 points Abbey Company has compiled this information related to a new project: Initial investment: $460,000; Fixed costs: $256,000, Variable costs: $16 per unit; Selling price: $40 per unit: Discount rate: 13 percent; Project life: 5 years: Tax rate: 25 percent. Fixed assets are depreciated using straight-line depreciation over the project's life. What is the financial break-even point? 18,547 18,018 17,520 17,008 16,655

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts