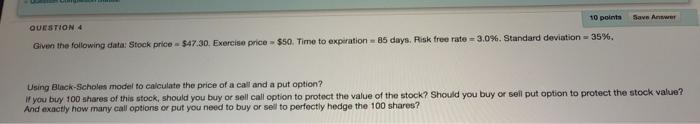

Question: Save Anwer QUESTION 4 10 points Given the following data: Stock price - $47.30. Exercise price $50. Time to expiration - 85 days. Risk free

Save Anwer QUESTION 4 10 points Given the following data: Stock price - $47.30. Exercise price $50. Time to expiration - 85 days. Risk free rate=3.0%. Standard deviation - 35% Using Black-Schole model to calculate the price of a call and a put option? If you buy 100 shares of this stock, should you buy or sell call option to protect the value of the stock? Should you buy or sell put option to protect the stock value? And exactly how many call options or put you need to buy or sell to perfectly hedge the 100 shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts