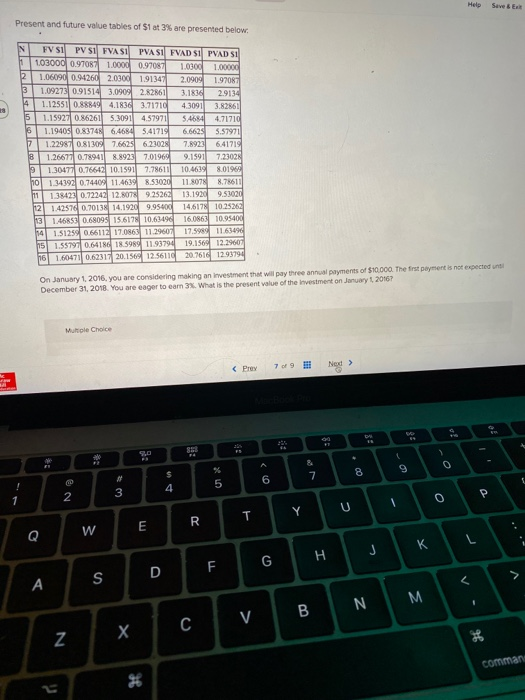

Question: Save & E Present and future value tables of $1 at 3% are presented below FV SI PV SI FVA SI PVA SI FVAD SI

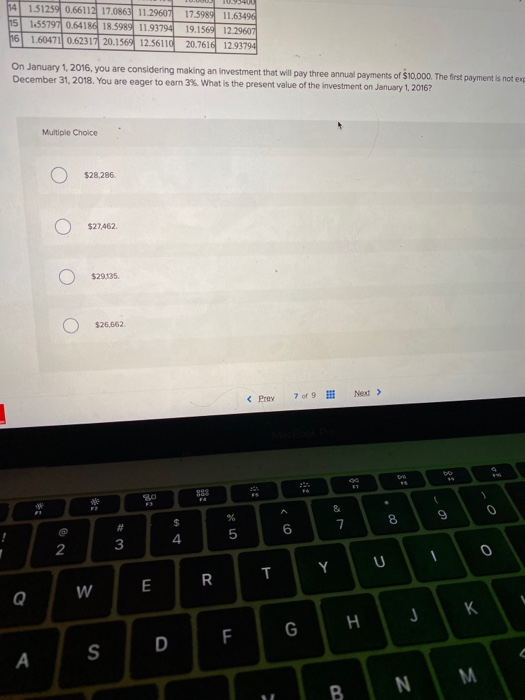

Save & E Present and future value tables of $1 at 3% are presented below FV SI PV SI FVA SI PVA SI FVAD SI PVAD SI 11 1030000.97087 1.0000 0.97087 1.0300 1.00000 2 1.06090 0.94260 2.0300 1.91347 2.0909 1.97087 3 1.09273 0.91514 3.0909 2.82861 3.1836 2.9134 4 1.12551 0.88849 4.1836 3.71710 43091 3.82861 5 1.15927 0.86261 5.3091 4.57971 5.4684 4.71710 6 1.19405 0.83748 6.4684 5.41719 6.6625 5.57971 27 1.22987 0.81309 7.6625 6.23028 7.892 6.41719 8 1.26677 0.789411 8.8923 7.01965 9.1591 7.23028 9 1.30477 0.76642 10.1591 7.78611 10.4639 8.0196 10 1.34392 0.7440911.4639 8.53020 11.8078 8.78611 111 1.38423 0.72242 12.8078925262 13.1920 9.53020 12 1.4257 0.70138 14.1920 9.95400 14.6178 10.25262 13 1.46853 0.68099 15.6178 10.63490 16.086 10.95400 14 1.51259 0.66112 17.0863 11.2960 7.5989 11.6309 15 1.55797 064186 1 599 1193794 19.1569 12.2960 16 1.60471 0.6231 20.1569 12.56116 20.7616 1293794 On January 1, 2016. you are considering making an investment that will pay three annual payments of $10.000. The first payment is not expected until December 31, 2018. You are eager to earn 3%. What is the present value of the investment on January 2016? Moe Choice A 1 183 0 & 7 8 o $ 4 # 3 6 5 2 0 T Y W E R G H J K F D S A M B N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts