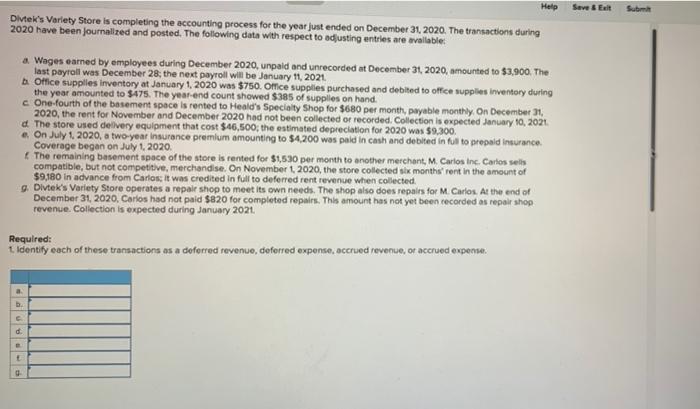

Question: Save & Eelt Help Divteks Variety Store is completing the accounting process for the year just ended on December 31, 2020. The transactions during 2020

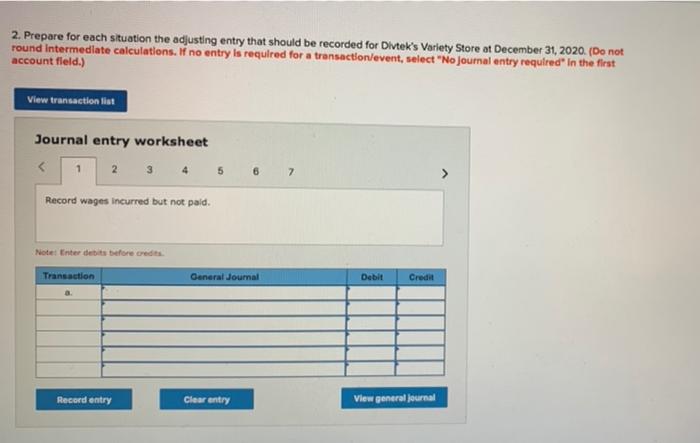

Save & Eelt Help Divteks Variety Store is completing the accounting process for the year just ended on December 31, 2020. The transactions during 2020 have been journalized and posted. The following data with respect to adjusting entries are available. a Wages earned by employees during December 2020, unpaid and unrecorded at December 31, 2020, amounted to $3,900. The last payroll was December 28; the next payroll will be January 11, 2021 be Office supplies inventory at January 1, 2020 was $750. Office supplies purchased and debited to office supplies inventory during the year amounted to $475. The year-end count showed $385 of supplies on hand. c One fourth of the basement space is rented to Heald's Specialty Shop for $680 per month payable monthly On December 31, 2020, the rent for November and December 2020 had not been collected or recorded. Collection is expected January 10, 2021 The store used delivery equipment that cost $46,500, the estimated depreciation for 2020 was $9.300 e On July 1 2020, a two-year Insurance premium amounting to $4.200 was paid in cash and debited in ful to prepaid insurance Coverage began on July 1, 2020 The remaining basement space of the store is rented for $1,530 per month to another merchant, M. Carlos Inc. Carios sells compatible, but not competitive, merchandise. On November 1, 2020, the store collected six months rent in the amount of $9,180 in advance from Carlos; it was credited in full to deferred rent revenue when collected Dive's Variety Store operates a repair shop to meet its own needs. The shop also does repairs for M. Carlos. At the end of December 31, 2020. Carlos had not paid $820 for completed repairs. This amount has not yet been recorded as repair shop revenue. Collection is expected during January 2021 Required: 1. Identify each of these transactions as a deferred revenue, deferred expense, accrued revenue, or accrued expense. PAIP d 2. Prepare for each situation the adjusting entry that should be recorded for Divtek's Variety Store at December 31, 2020. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts