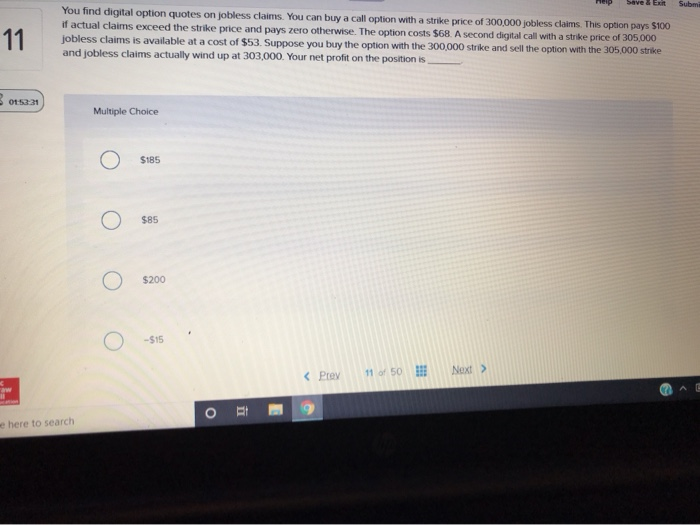

Question: Save & ERR Subm 11 You find digital option quotes on jobless claims. You can buy a call option with a strike price of 300,000

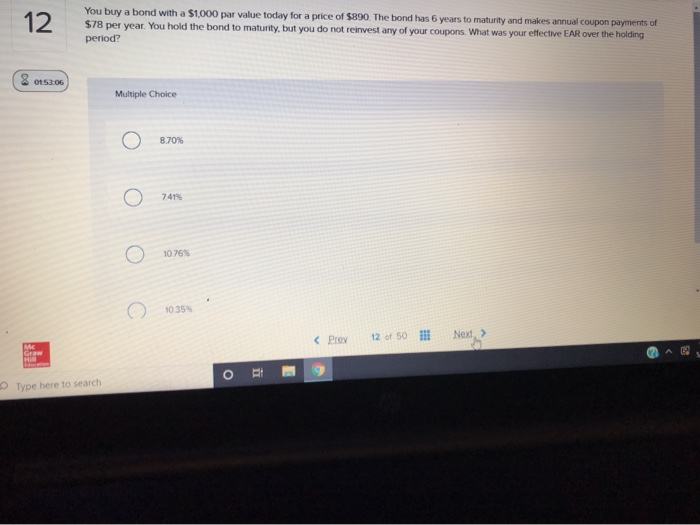

Save & ERR Subm 11 You find digital option quotes on jobless claims. You can buy a call option with a strike price of 300,000 jobless claims. This option pays $100 if actual claims exceed the strike price and pays zero otherwise. The option costs $68. A second digital call with a strike price of 305.000 jobless claims is available at a cost of $53. Suppose you buy the option with the 300,000 strike and sell the option with the 305,000 strike and jobless claims actually wind up at 303,000. Your net profit on the position is 3 01:53:21 Multiple Choice $185 $85 O O $200 -$15 i o e here to search 12 You buy a bond with a $1,000 par value today for a price of $890. The bond has 6 years to maturity and makes annual coupon payments of $78 per year. You hold the bond to maturity, but you do not reinvest any of your coupons. What was your effective EAR over the holding period? 01:53:06 Multiple Choice 8.70% O 7419 10.76% 10.35 he Grow RE O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts