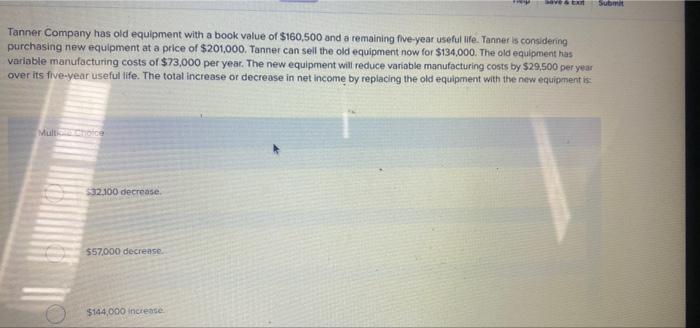

Question: Save & Ex Submit Tanner Company has old equipment with a book value of $160,500 and a remaining five-year useful life. Tanner is considering

Save & Ex Submit Tanner Company has old equipment with a book value of $160,500 and a remaining five-year useful life. Tanner is considering purchasing new equipment at a price of $201,000. Tanner can sell the old equipment now for $134,000. The old equipment has variable manufacturing costs of $73,000 per year. The new equipment will reduce variable manufacturing costs by $29,500 per year over its five-year useful life. The total increase or decrease in net income by replacing the old equipment with the new equipment is: MultiChoice $32.100 decrease. $57,000 decrease. $144,000 increase

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock