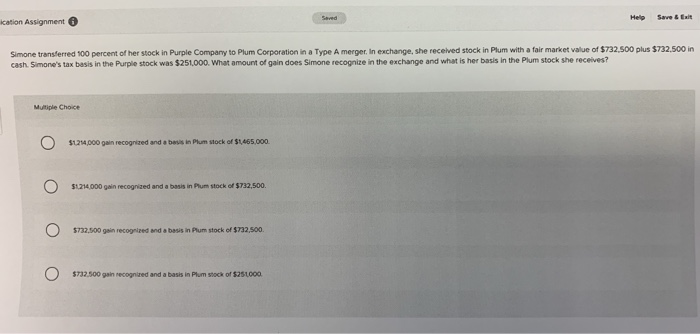

Question: Save & Exit Help Seved ication Assignment Simone transferred 100 percent of her stock in Purple Company to Plum Corporation in a Type A merger.

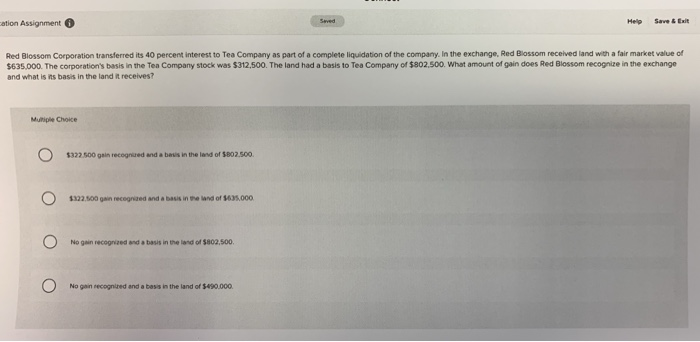

Save & Exit Help Seved ication Assignment Simone transferred 100 percent of her stock in Purple Company to Plum Corporation in a Type A merger. In exchange, she received stock in Plum with a fair market value of $732.500 plus $732.500 in cash. Simone's tax basis in the Purple stock was $251,000. What amount of gain does Simone recognize in the exchange and what is her basis in the Plum stock she receives? Multiple Choice $1214,000 gain recognized and a basis in Plum stock of $465.000 $1214000 gain recognized and a basis in Plum stock of $732.500. $732,500 gain recognized and a basis in Plum stock of $732.500 $732,500 gain recognized and a basis in Plum stock of $251000. Save &Exit Saved Help ation Assignment Red Blossom Corporation transferred its 40 percent interest to Tea Company as part of a complete liquidation of the company. In the exchange, Red Blossom received land with a fair market value of $635,000. The corporation's basis in the Tea Company stock was $312,500. The land had a basis to Tea Company of $802.500. What amount of gain does Red Blossom recognize in the exchange and what is ins basis in the land it receives? Mutiple Choice $322.500 gain recognized and a basis in the land of $802.500. 1322.500 gain recognized and a basis in the land of $635,000 No gain recognized and a basis in the land of $802,500. No gain recognized and a bess in the land of $490.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts