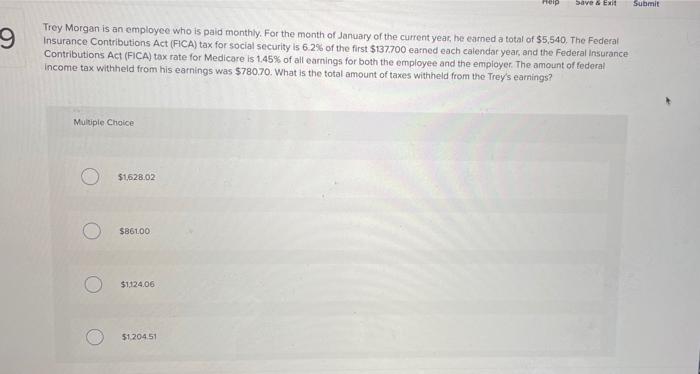

Question: Save & Exit Submit 9 Trey Morgan is an employee who is paid monthly. For the month of January of the current year, he earned

Save & Exit Submit 9 Trey Morgan is an employee who is paid monthly. For the month of January of the current year, he earned a total of $5.540. The Federal Insurance Contributions Act (FICA) tax for social security is 6.2% of the first $137.700 earned each calendar year, and the Federal Insurance Contributions Act (FICA) tax rate for Medicare is 1.45% of all earnings for both the employee and the employer. The amount of federal Income tax withheld from his earnings was $780.70. What is the total amount of taxes withheld from the Trey's earnings? Multiple Choice $1,628.02 $86100 O $1.124.06 5120451 Multiple Choice $1,528.02 $86100 $1124.06 $1,204.51 $78070

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts