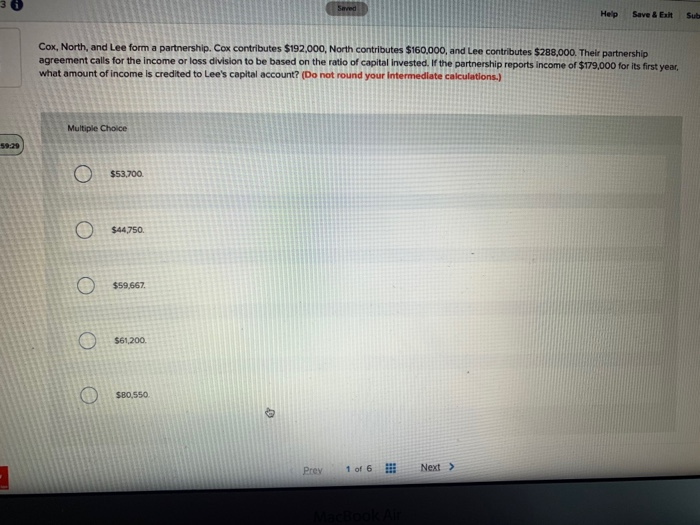

Question: Save & Ext Cox, North, and Lee forma partnership. Cox contributes $192,000, North contributes $160,000, and Lee contributes $288,000. Thele partnership agreement calls for the

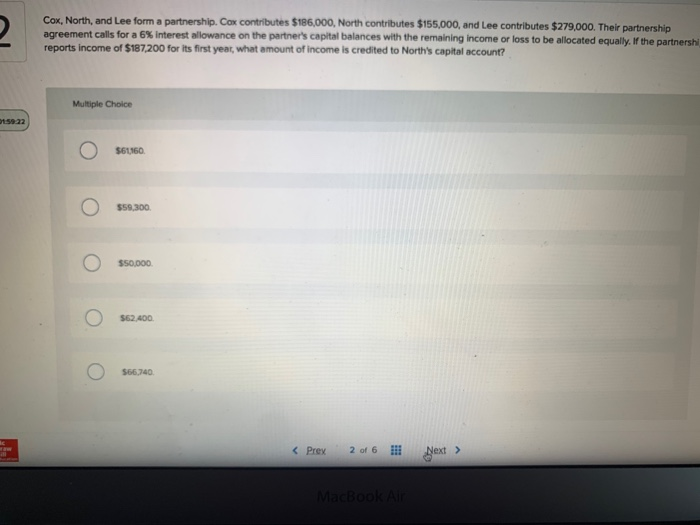

Save & Ext Cox, North, and Lee forma partnership. Cox contributes $192,000, North contributes $160,000, and Lee contributes $288,000. Thele partnership agreement calls for the income or loss division to be based on the ratio of capital invested. If the partnership reports income of $179,000 for its first year, what amount of income is credited to Lee's capital account? (Do not round your intermediate calculations.) Multiple Choice O $53.700 0 0 0 0 Prey 1 of 6 !!! Next > Cox, North, and Lee forma partnership. Cox contributes $186,000, North contributes $155,000, and Lee contributes $279,000. Their partnership agreement calls for a 6% Interest allowance on the partner's capital balances with the remaining Income or loss to be allocated equally. If the partnersh reports income of $187.200 for its first year, what amount of income is credited to North's capital account? Multiple Choice . .

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts