Question: Save Homework: Chapter 8. Risk and Question 16, P8-29 (book/static) HW Score: 0%, 0 of 20 points Return Part 1 of 6 O Points: 0

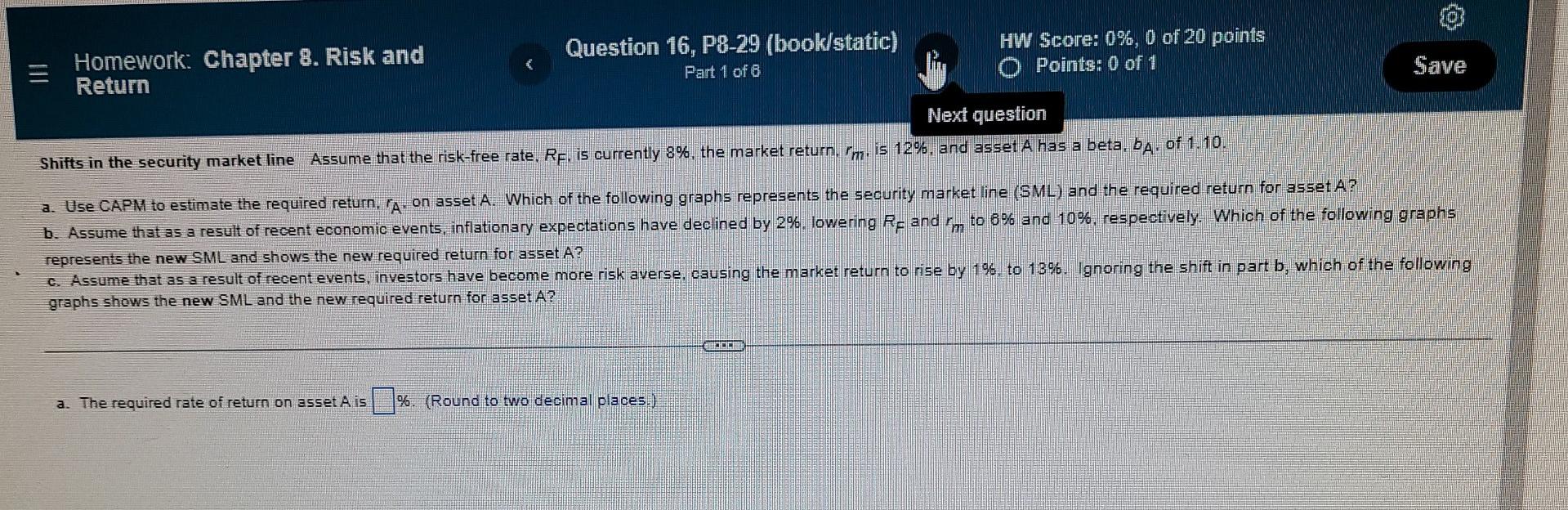

Save Homework: Chapter 8. Risk and Question 16, P8-29 (book/static) HW Score: 0%, 0 of 20 points Return Part 1 of 6 O Points: 0 of 1 Next question Shifts in the security market line Assume that the risk-free rate. Rp. is currently 8%, the market return, ime is 12%, and asset A has a beta, ba. of 1.10. a. Use CAPM to estimate the required return, A. on asset A. Which of the following graphs represents the security market line (SML) and the required return for asset A? b. Assume that as a result of recent economic events, inflationary expectations have declined by 2%. lowering Re and i'm to 8% and 10%, respectively. Which of the following graphs represents the new SML and shows the new required return for asset A? C. Assume that as a result of recent events, investors have become more risk averse, causing the market return to rise by 196. to 1396. Ignoring the shift in part b, which of the following graphs shows the new SML and the new required return for asset A? a. The required rate of return on asset Ais %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts