Question: Save Homework: HW 4b - Fin. statement analysis Score: 0 of 3 pts 1 of 8 (5 complete HW Score: 53.18%, 11.7 of 22 pts

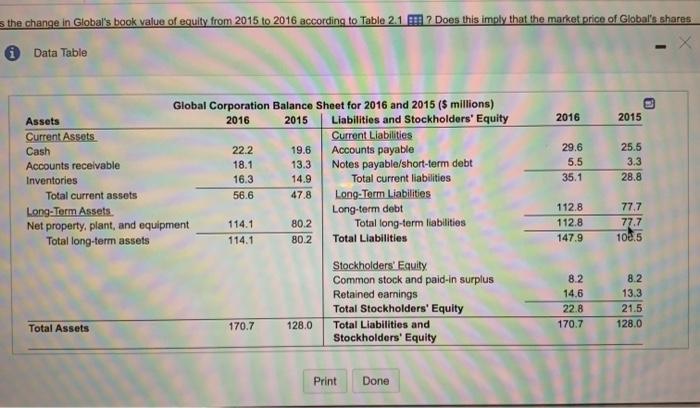

Save Homework: HW 4b - Fin. statement analysis Score: 0 of 3 pts 1 of 8 (5 complete HW Score: 53.18%, 11.7 of 22 pts P 2-5 (similar to) Question Help What was the change in Global's book value of equity from 2015 to 2016 according to Table 2.1 ? Does this imply that the market price of Global's shares increased in 2016? Explain What was the change in Global's book value of equity from 2015 to 2016? Globals book value of equity changed by $ million from 2015 to 2016. (Round to one decimal place) Enter your answer in the answer box and then click Check Answer. 1 part remaining - Clear All Check Air the change in Global's book value of equity from 2015 to 2016 according to Table 2.1 ? Does this imply that the market price of Global's shares Data Table 2016 2015 29.6 5.5 35.1 25.5 3.3 28.8 Global Corporation Balance Sheet for 2016 and 2015 ($ millions) Assets 2016 2015 Liabilities and Stockholders' Equity Current Assets Current Liabilities Cash 22.2 19.6 Accounts payable Accounts receivable 18.1 13.3 Notes payable/short-term debt Inventories 16.3 14.9 Total current liabilities Total current assets 56.6 47.8 Long-Term Liabilities Long-Term Assets. Long-term debt Net property, plant, and equipment 114.1 80.2 Total long-term liabilities Total long-term assets 114.1 80.2 Total Liabilities Stockholders' Equity Common stock and paid-in surplus Retained earnings Total Stockholders' Equity Total Assets 170.7 128.0 Total Liabilities and Stockholders' Equity 112.8 112.8 147.9 77,7 77.7 106.5 8.2 14.6 22.8 170.7 8.2 13.3 21.5 128.0 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts