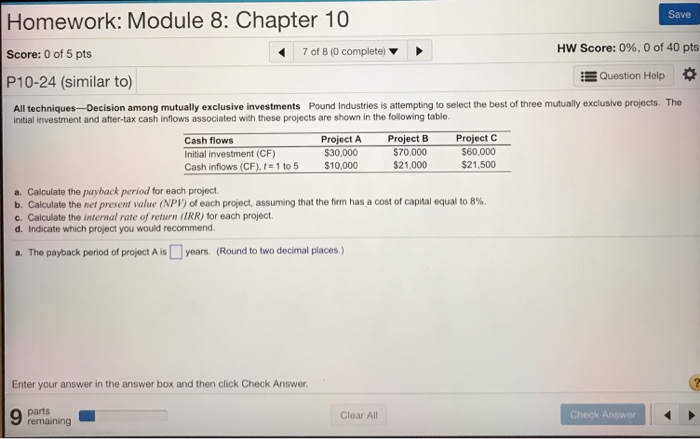

Question: Save Homework: Module 8: Chapter 10 7 of 8 (0 complete) Hw Score: 0%, 0 of 40 pts Score: 0 of 5 pts P10-24 (similar

Save Homework: Module 8: Chapter 10 7 of 8 (0 complete) Hw Score: 0%, 0 of 40 pts Score: 0 of 5 pts P10-24 (similar to) All techniques-Decision among mutually exclusive investments Pound Industries is atempting to select the best of three mutually exclusive projects. The Question Help * initial investment and after-tax cash inflows associated with these projects are shown in the following table. Cash flows Initial investment (CF) Cash inflows (CF), t = 1 to 5 Project A $30,000 S10.000 Project B 70,000 $21,000 Project C $60,000 $21,500 a. Calculate the payback period for each project b. Calculate the net present value (NPI) of each project, assuming that the firm has a cost of capital equal to 8%. c. Calculate the internal rate of return (IRR) for each project. d. Indicate which project you would recommend. The payback period of project A is years. (Round to two decimal places.) a. Enter your answer in the answer box and then click Check Answer. parts Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts