Question: Save Homework: Module 8 - Risk and Return Score: 0 of 1 pt P8-23 (similar to) 9 of 10 (8 complete) ? Hw Score: 80%,

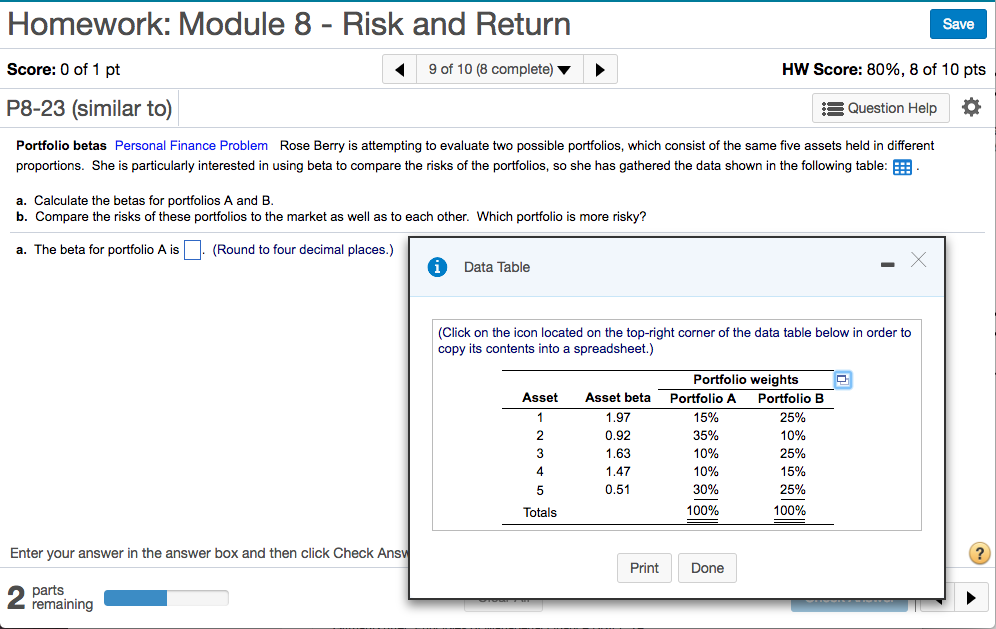

Save Homework: Module 8 - Risk and Return Score: 0 of 1 pt P8-23 (similar to) 9 of 10 (8 complete) ? Hw Score: 80%, 8 of 10 pts Question Help Portfolio betas Personal Finance Problem Rose Berry is attempting to evaluate two possible portfolios, which consist of the same five assets held in different proportions. She is particularly interested in using beta to compare the risks of the portfolios, so she has gathered the data shown in the following table: a. Calculate the betas for portfolios A and B b. Compare the risks of these portfolios to the market as well as to each other. Which portfolio is more risky? a. The beta for portfolio A is(Round to four decimal places.) Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Portfolio weights Asset Asset beta Portfolio A Portfolio B 1.97 0.92 1.63 1.47 0.51 15% 35% 10% 10% 30% 100% 25% 10% 25% 15% 25% 100% 4 Totals Enter your answer in the answer box and then click Check Ans Done Print remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts