Question: Save Homework: Week Six : Chapter 7 : Exercises unting Score: 0 of 1 pt 5 of 15 (2 complete) HW Score: 13.33%, 2 of

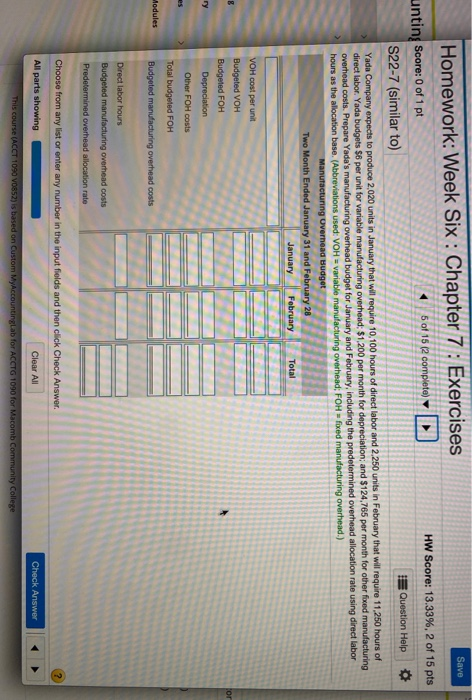

Save Homework: Week Six : Chapter 7 : Exercises unting Score: 0 of 1 pt 5 of 15 (2 complete) HW Score: 13.33%, 2 of 15 pts S22-7 (similar to) Question Help Yada Company expects to produce 2,020 units in January that will require 10,100 hours of direct labor and 2,250 units in February that will require 11,250 hours of direct labor. Yada budgets $6 per unit for variable manufacturing overhead: $1,200 per month for depreciation; and $124,765 per month for other foxed manufacturing overhead costs. Prepare Yada's manufacturing overhead budget for January and February, including the predetermined overhead allocation rate using direct labor hours as the allocation base. (Abbreviations used: VOH = variable manufacturing overhead; FOH = fixed manufacturing overhead.) Manufacturing Overhead Budget Two Month Ended January 31 and February 28 January February Total or ry VOH cost per unit Budgeted VOH Budgeted FOH Depreciation Other FOH costs Total budgeted FOH Budgeted manufacturing overhead costs Modules Direct labor hours Budgeted manufacturing overhead costs Predetermined overhead allocation rate Choose from any list or enter any number in the input fields and then click Check Answer. All parts showing Clear All Check Answer This course (ACCT 1090 0852) is based on Custom My AccountingLab for ACCTG 1090 for Macomb Community College

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts