Question: Save on Raez_Smart_Zutter_Problem_2.28_Start - Excel Search Home nsert Page Layout Formulas Data Review View Help ACROBAT Power Pivot & Cut Times New Roman ~ 14

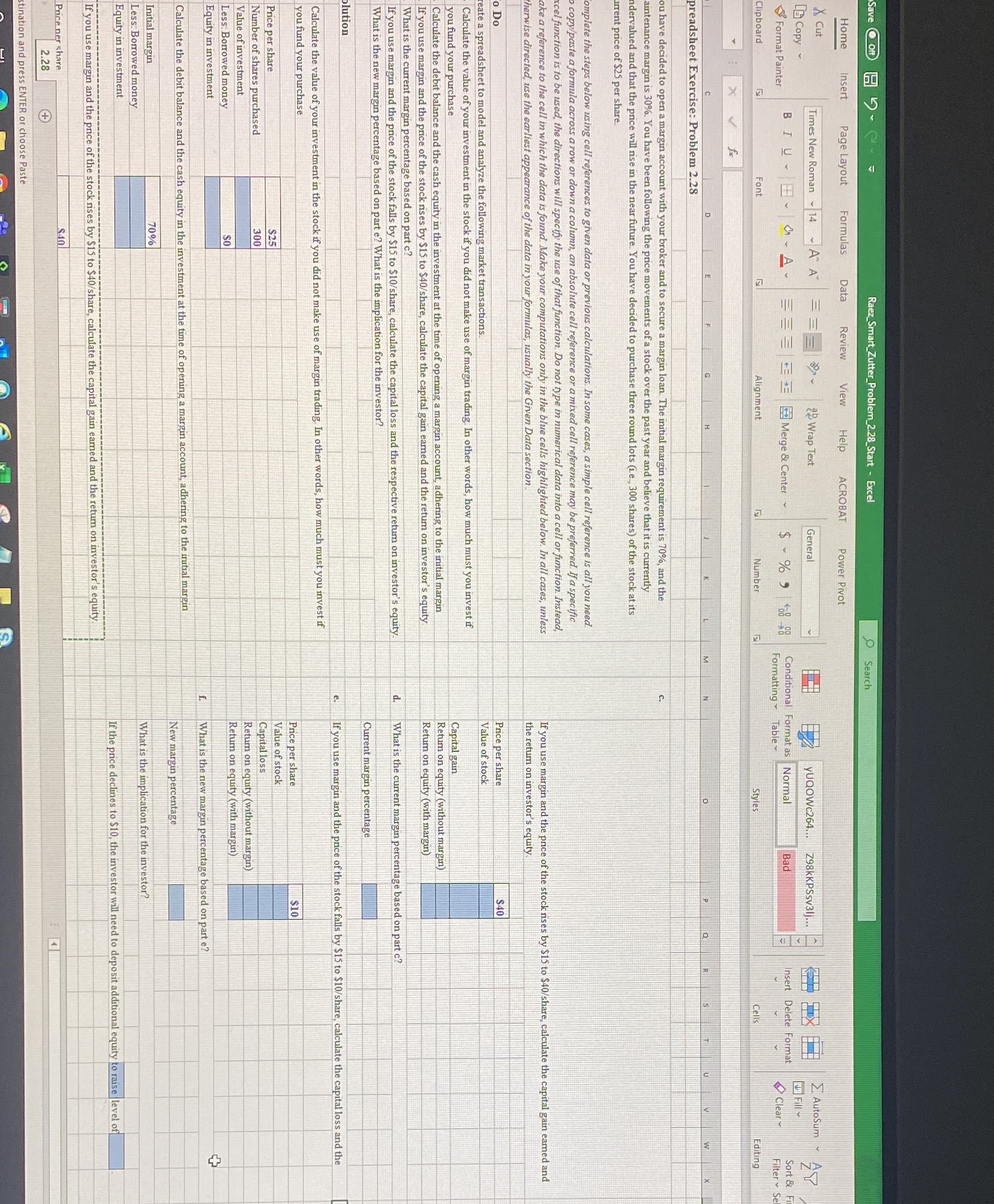

Save on Raez_Smart_Zutter_Problem_2.28_Start - Excel Search Home nsert Page Layout Formulas Data Review View Help ACROBAT Power Pivot & Cut Times New Roman ~ 14 ~ A" A 29 Wrap Text General [ Copy YUQOWC264... Z98KKPSsv3/j... E AutoSum ~ Fill Format Painter B I U - - MA E Merge & Center ~ % 9 8 98 Conditional Format as Normal Bad Insert Delete Format Sort & Formatting ~ Table Clear Filter ~ S Clipboard Font Alignment Number Styles Cells Editing X M w preadsheet Exercise: Problem 2.28 ou have decided to open a margin account with your broker and to secure a margin loan. The initial margin requirement is 70%, and the aintenance margin is 30%. You have been following the price movements of a stock over the past year and believe that it is currently ndervalued and that the price will rise in the near future. You have decided to purchase three round lots (Le, 300 shares) of the stock at its urent price of $25 per share. omplete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific cel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, ake a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless If you use margin and the price of the stock rises by $15 to $40/share, calculate the capital gain earned and therwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. the return on investor's equity o Do Price per share $40 eate a spreadsheet to model and analyze the following market transactions. Value of stock Calculate the value of your investment in the stock if you did not make use of margin trading. In other words, how much must you invest if you fund your purchase Capital gain Calculate the debit balance and the cash equity in the investment at the time of opening a margin account, adhering to the initial margin Return on equity ( without margin) If you use margin and the price of the stock rises by $15 to $40/share, calculate the capital gain earned and the return on investor's equity Return on equity (with margin) What is the current margin percentage based on part c? If you use margin and the price of the stock falls by $15 to $10/share, calculate the capital loss and the respective return on investor's equity. What is the current margin percentage based on part c? What is the new margin percentage based on part e? What is the implication for the investor? Current margin percentage olution If you use margin and the price of the stock falls by $15 to $10/share, calculate the capital loss and the Calculate the value of your investment in the stock if you did not make use of margin trading. In other words, how much must you invest if you fund your purchase Price per share $10 Price per share $25 Value of stock Number of shares purchased 300 Capital loss Value of investment Return on equity ( without margin) Less Borrowed money SO Return on equity (with margin) Equity in investment + What is the new margin percentage based on part e? Calculate the debit balance and the cash equity in the investment at the time of opening a margin account, adhering to the initial margin New margin percentage Initial margin 70% Less Borrowed money What is the implication for the investor? Equity in investment If the price declines to $10, the investor will need to deposit additional equity to raise level of If you use margin and the price of the stock rises by $15 to $40/share, calculate the capi n earned and the return on investor's equity. Pace ner share $40 2.28 tination and press ENTER or choose Paste