Question: Save Submit Assignment for Grading Problem 14-07 (Investment Timing Option: Option Analysis Question of A-Z Check My Work (5 remaining) eBook Investment Timing Option: Option

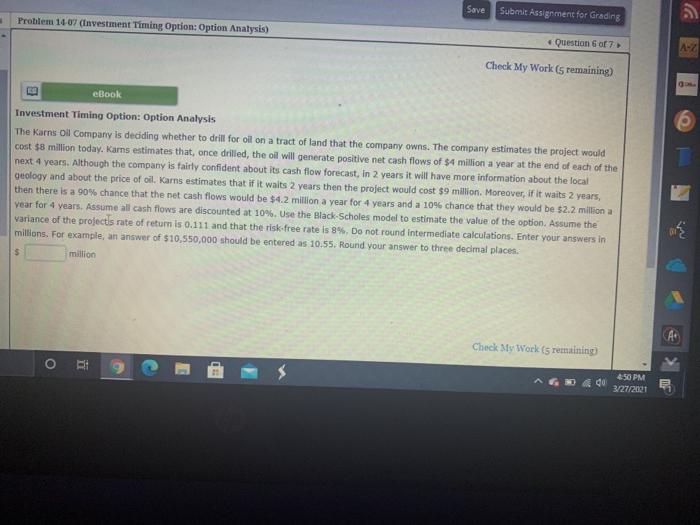

Save Submit Assignment for Grading Problem 14-07 (Investment Timing Option: Option Analysis Question of A-Z Check My Work (5 remaining) eBook Investment Timing Option: Option Analysis The Karns Oll Company is deciding whether to drill for oil on a tract of land that the company owns. The company estimates the project would cost $8 million today. Karns estimates that, once drilled, the oil will generate positive net cash flows of $4 million a year at the end of each of the next 4 years. Although the company is fairly confident about its cash flow forecast, in 2 years it will have more information about the local geology and about the price of oil. Karns estimates that if it waits 2 years then the project would cost $9 million. Moreover, if it waits 2 years, then there is a 90% chance that the net cash flows would be $4.2 million a year for 4 years and a 10% chance that they would be $2.2 million a Year for 4 years. Assume all cash flows are discounted at 10%. Use the Black Scholes model to estimate the value of the option. Assume the variance of the projects rate of return is 0.111 and that the risk-free rate is 8%. Do not round intermediate calculations. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to three decimal places. million $ Check 3 Work (s remaining) O AGD d 4:50 PM 3/27/2021 Save Submit Assignment for Grading Problem 14-07 (Investment Timing Option: Option Analysis Question of A-Z Check My Work (5 remaining) eBook Investment Timing Option: Option Analysis The Karns Oll Company is deciding whether to drill for oil on a tract of land that the company owns. The company estimates the project would cost $8 million today. Karns estimates that, once drilled, the oil will generate positive net cash flows of $4 million a year at the end of each of the next 4 years. Although the company is fairly confident about its cash flow forecast, in 2 years it will have more information about the local geology and about the price of oil. Karns estimates that if it waits 2 years then the project would cost $9 million. Moreover, if it waits 2 years, then there is a 90% chance that the net cash flows would be $4.2 million a year for 4 years and a 10% chance that they would be $2.2 million a Year for 4 years. Assume all cash flows are discounted at 10%. Use the Black Scholes model to estimate the value of the option. Assume the variance of the projects rate of return is 0.111 and that the risk-free rate is 8%. Do not round intermediate calculations. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Round your answer to three decimal places. million $ Check 3 Work (s remaining) O AGD d 4:50 PM 3/27/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts