Question: Save Submit Assignment for Grading Questions Problem 7-14 (Declining FCF Growth Valuation) Question 5 of 6 Check My Work . 4. 5. eBook 6. Declining

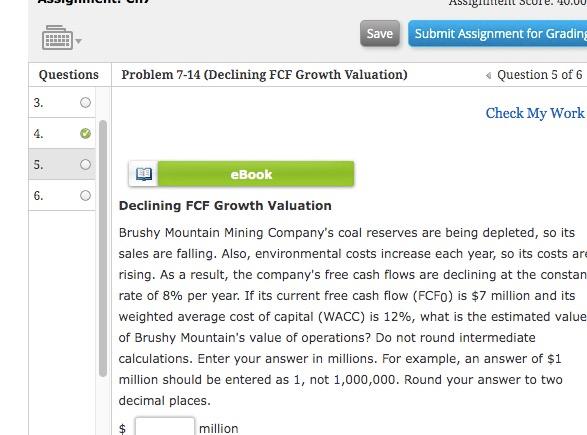

Save Submit Assignment for Grading Questions Problem 7-14 (Declining FCF Growth Valuation) Question 5 of 6 Check My Work . 4. 5. eBook 6. Declining FCF Growth Valuation Brushy Mountain Mining Company's coal reserves are being depleted, so its sales are falling. Also, environmental costs increase each year, so its costs are rising. As a result, the company's free cash flows are declining at the constan rate of 8% per year. If its current free cash flow (FCFO) is $7 million and its weighted average cost of capital (WACC) is 12%, what is the estimated value of Brushy Mountain's value of operations? Do not round intermediate calculations. Enter your answer in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answer to two decimal places. million $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts