Question: Save SUUTI TESTTUR UTD oblem 7.17 (Bond Returns) Question 9 of 3 eBook Problem Walk-Through Last year Janet purchased a $1,000 face value corporate bond

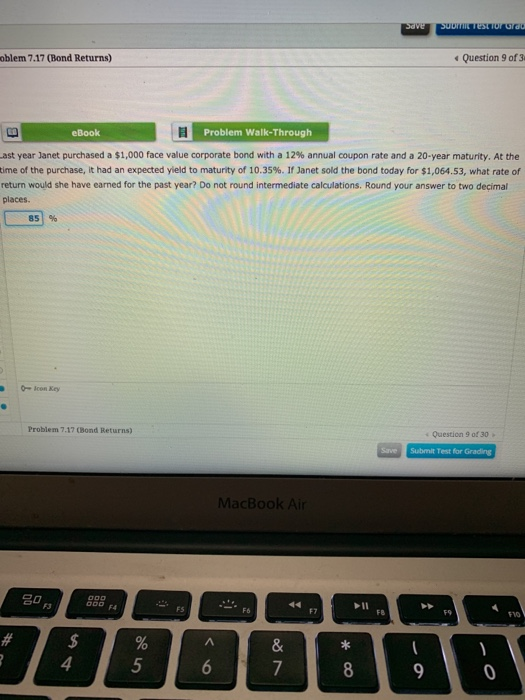

Save SUUTI TESTTUR UTD oblem 7.17 (Bond Returns) Question 9 of 3 eBook Problem Walk-Through Last year Janet purchased a $1,000 face value corporate bond with a 12% annual coupon rate and a 20-year maturity. At the time of the purchase, it had an expected yield to maturity of 10.35%. If Janet sold the bond today for $1,064.53, what rate of return would she have earned for the past year? Do not round intermediate calculations, Round your answer to two decimal places. 85 % . - Bon Key Problem 7.17 Bond Returns) Question 9 of 30 Submit Test for Grading Save MacBook Air gors DOO ODD F4 II F6 F7 FO # * $ 4 ) 5 & 7 6 8 9 0

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock