Question: Save the Squirrels, Inc., a $ 501(c)(3) organization that feeds the squirrels in municipal parks, receives a $250,000 contribution from Animal Feed, Inc., a for-profit

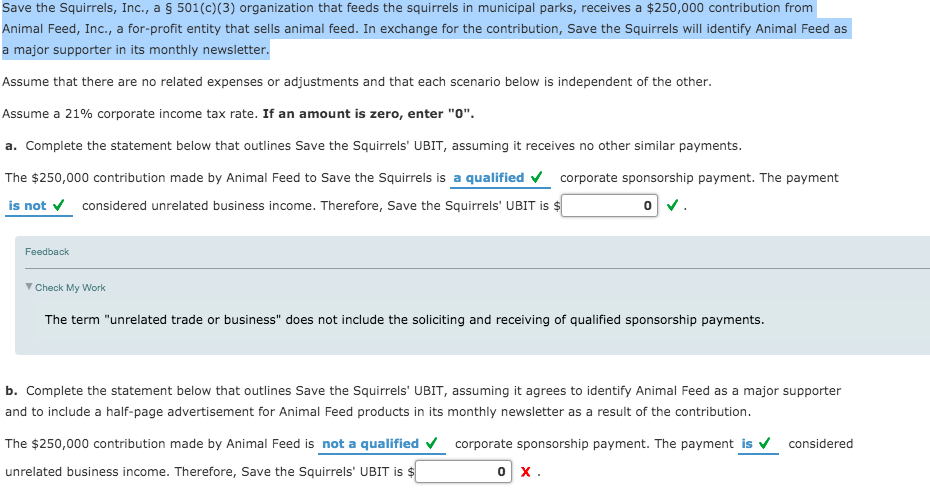

Save the Squirrels, Inc., a $ 501(c)(3) organization that feeds the squirrels in municipal parks, receives a $250,000 contribution from Animal Feed, Inc., a for-profit entity that sells animal feed. In exchange for the contribution, Save the Squirrels will identify Animal Feed as a major supporter in its monthly newsletter. Assume that there are no related expenses or adjustments and that each scenario below is independent of the other. Assume a 21% corporate income tax rate. If an amount is zero, enter "O". a. Complete the statement below that outlines Save the Squirrels' UBIT, assuming it receives no other similar payments. The $250,000 contribution made by Animal Feed to Save the Squirrels is a qualified corporate sponsorship payment. The payment is not considered unrelated business income. Therefore, Save the Squirrels' UBIT is $ 0 . Feedback Check My Work The term "unrelated trade or business" does not include the soliciting and receiving of qualified sponsorship payments. b. Complete the statement below that outlines Save the Squirrels' UBIT, assuming it agrees to identify Animal Feed as a major supporter and to include a half-page advertisement for Animal Feed products in its monthly newsletter as a result of the contribution. considered The $250,000 contribution made by Animal Feed is not a qualified unrelated business income. Therefore, Save the Squirrels' UBIT is $ corporate sponsorship payment. The payment is 0 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts