Question: Saved 14 Homework Assignment Help Exercise 14A-2 (Algo) Basic Present Value Concepts (L014-7) Julie has just retired. Her company's retirement program has two options as

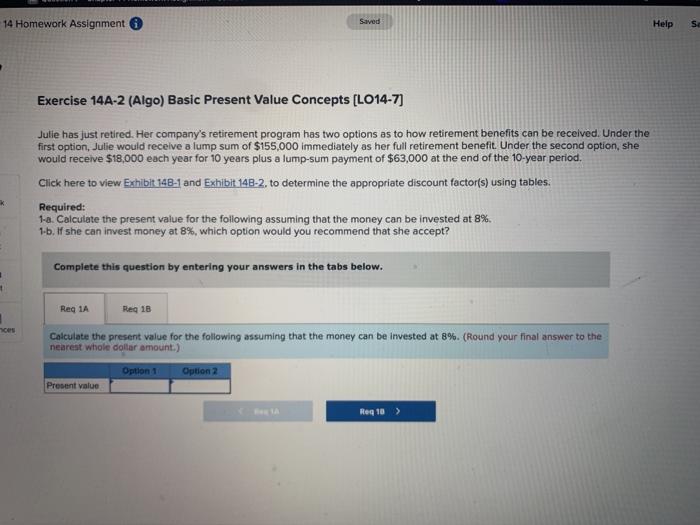

Saved 14 Homework Assignment Help Exercise 14A-2 (Algo) Basic Present Value Concepts (L014-7) Julie has just retired. Her company's retirement program has two options as to how retirement benefits can be received. Under the first option, Julie would receive a lump sum of $155,000 immediately as her full retirement benefit. Under the second option, she would receive $18,000 each year for 10 years plus a lump-sum payment of $63,000 at the end of the 10-year period. Click here to view Exhibit 148-1 and Exhibit 148-2. to determine the appropriate discount factor(s) using tables. Required: 1-a. Calculate the present value for the following assuming that the money can be invested at 8%. 1-6. If she can invest money at 8%, which option would you recommend that she accept? * Complete this question by entering your answers in the tabs below. Reg 1A Reg 16 Calculate the present value for the following assuming that the money can be invested at 8%. (Round your final answer to the nearest whole dollar amount.) Option 1 Option 2 Present value Reg 10 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts