Question: Saved ase e and Ross should use when shopping for life insurance. Each answer must have a value for the as for any unused

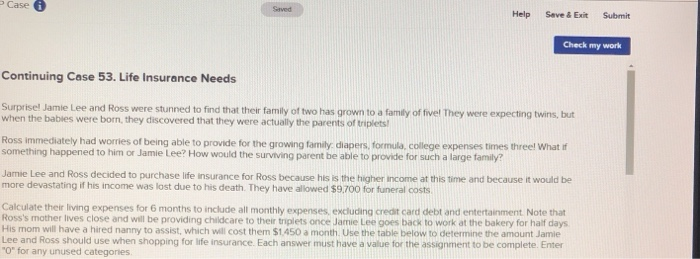

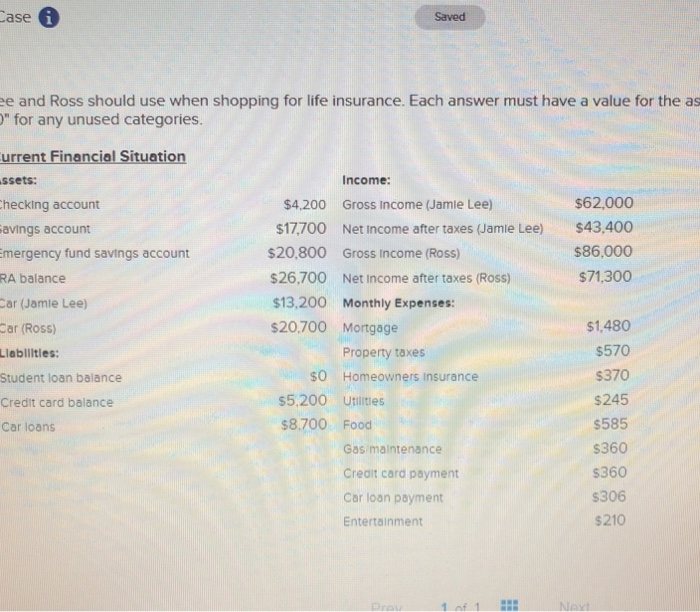

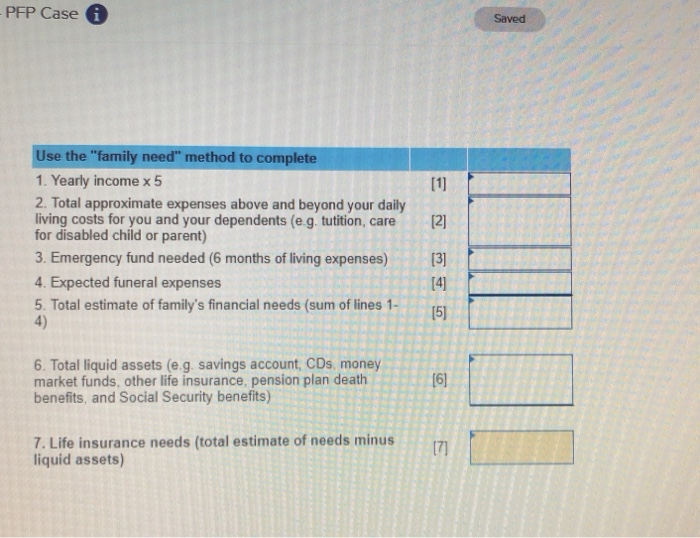

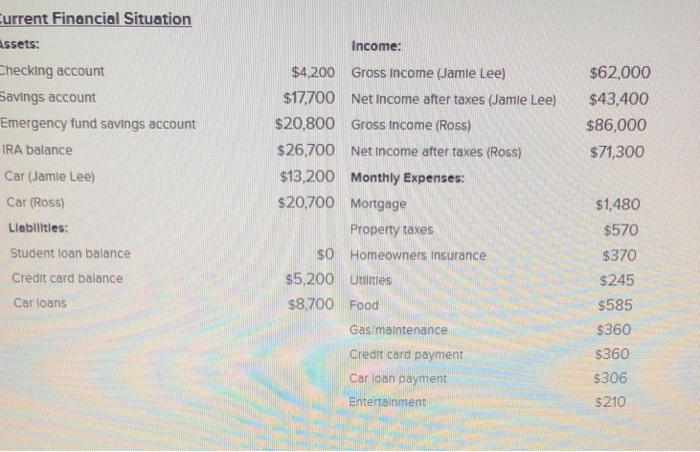

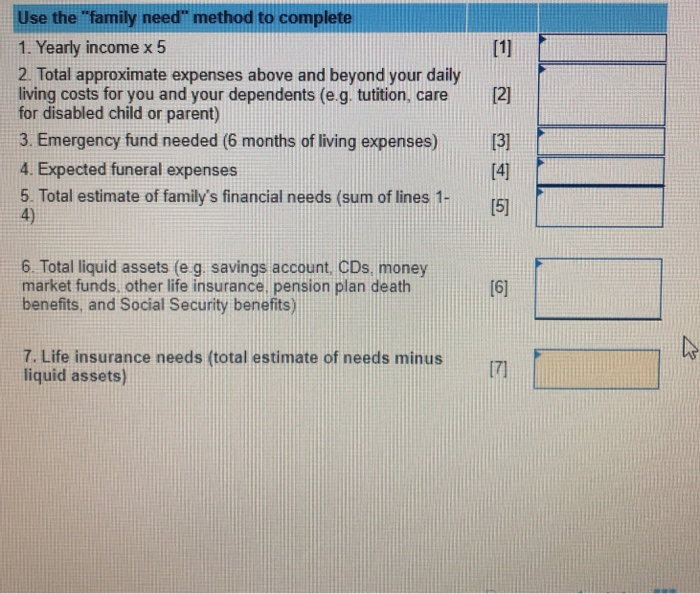

Saved ase e and Ross should use when shopping for life insurance. Each answer must have a value for the as " for any unused categories. urrent Financial Situation ssets: hecking account avings account mergency fund savings account RA balance Car (Jamle Lee) Car (Ross) Llabltles: Student loan balance Credit card balance Car loans Income: $62,000 $4,200 Gross income (Jamle Lee) $17,700 Net income after taxes (Jamie Lee) $43,400 $86,000 $71,300 $20,800 Gross income (Ross) $26,700 Net Income after taxes (Ross) $13,200 Monthly Expenses: s20,700 Mortgage $1,480 $570 $370 $245 $585 $360 $360 $306 $210 Property taxes $O Homeowners insurance s5.200 Utlities $8,700 Food Gas maintenance Credit card payment Car loan payment Entertainment Continuing Case 53. Life Insurance Needs Surprisel Jamie Lee and Ross were stunned to find that their family of two has grown to a family of five! They were expecting twins, but when the babies were born, they discovered that they were actually the parents of triplets Ross immediately had worries of being able to provide for the growing family diapers, formula, college expenses times three! What if something happened to him or Jamie Lee? How would the surviving parent be able to provide for such a large family? Jamie Lee and Ross decided to purchase life insurance for Ross because his is the higher income at this time and because it would be more devastating if his income was lost due to his death. They have allowed $9700 for funeral costs Calculate their living expenses for 6 months to include all monthly expenses, excluding credit card debt and entertainment Note that Ross's mother lives close and will be providing childcare to their triplets once Jamie Lee goes back to work at the bakery for half days. His mom will have a hired nanny to assist, which will cost them $1,450 a month. Use the table below to determine the amount Jamie Lee and Ross should use when shopping for life insurance Each answer must have a value for the assignment to be complete. Enter 'O* for any unused categories. urrent Financial Situation ssets: hecking account Savings account Emergency fund savings account IRA balance Car (Jamie Lee) Car (Ross) Income: $62,000 $4.200 Gross Income (Jamle Lee) s17,700 Net income after taxes (Jamie Lee) $43,400 $20,800 Gross Income (Ross) $26,700 Net income after taxes (Ross) $13,200 Monthly Expenses: s20,700 Mortgage $86,000 $71,300 $1,480 $570 $370 $245 $585 $360 $360 $306 $210 Liablitles: Property taxes $0 Homeowners insurance Student loan balance Credit card balance Car loans $5,200 Uities $8,700 Food Gas maintenance Credit card payment Car loan payment Entertainment Saved ase e and Ross should use when shopping for life insurance. Each answer must have a value for the as " for any unused categories. urrent Financial Situation ssets: hecking account avings account mergency fund savings account RA balance Car (Jamle Lee) Car (Ross) Llabltles: Student loan balance Credit card balance Car loans Income: $62,000 $4,200 Gross income (Jamle Lee) $17,700 Net income after taxes (Jamie Lee) $43,400 $86,000 $71,300 $20,800 Gross income (Ross) $26,700 Net Income after taxes (Ross) $13,200 Monthly Expenses: s20,700 Mortgage $1,480 $570 $370 $245 $585 $360 $360 $306 $210 Property taxes $O Homeowners insurance s5.200 Utlities $8,700 Food Gas maintenance Credit card payment Car loan payment Entertainment Continuing Case 53. Life Insurance Needs Surprisel Jamie Lee and Ross were stunned to find that their family of two has grown to a family of five! They were expecting twins, but when the babies were born, they discovered that they were actually the parents of triplets Ross immediately had worries of being able to provide for the growing family diapers, formula, college expenses times three! What if something happened to him or Jamie Lee? How would the surviving parent be able to provide for such a large family? Jamie Lee and Ross decided to purchase life insurance for Ross because his is the higher income at this time and because it would be more devastating if his income was lost due to his death. They have allowed $9700 for funeral costs Calculate their living expenses for 6 months to include all monthly expenses, excluding credit card debt and entertainment Note that Ross's mother lives close and will be providing childcare to their triplets once Jamie Lee goes back to work at the bakery for half days. His mom will have a hired nanny to assist, which will cost them $1,450 a month. Use the table below to determine the amount Jamie Lee and Ross should use when shopping for life insurance Each answer must have a value for the assignment to be complete. Enter 'O* for any unused categories. urrent Financial Situation ssets: hecking account Savings account Emergency fund savings account IRA balance Car (Jamie Lee) Car (Ross) Income: $62,000 $4.200 Gross Income (Jamle Lee) s17,700 Net income after taxes (Jamie Lee) $43,400 $20,800 Gross Income (Ross) $26,700 Net income after taxes (Ross) $13,200 Monthly Expenses: s20,700 Mortgage $86,000 $71,300 $1,480 $570 $370 $245 $585 $360 $360 $306 $210 Liablitles: Property taxes $0 Homeowners insurance Student loan balance Credit card balance Car loans $5,200 Uities $8,700 Food Gas maintenance Credit card payment Car loan payment Entertainment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts