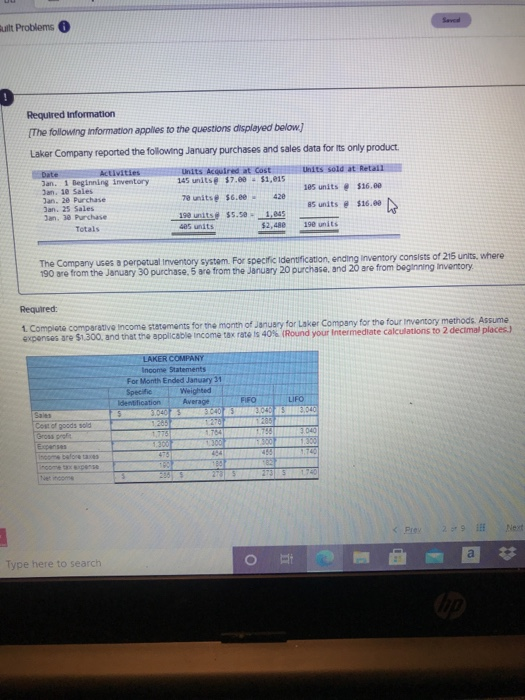

Question: - Saved Built Problems Required information [The following information applies to the questions displayed below) Laker Company reported the following January purchases and sales data

- Saved Built Problems Required information [The following information applies to the questions displayed below) Laker Company reported the following January purchases and sales data for its only product. Date Activities Units Acquired at Cost Units sold at Retail Jan. 1 Beginning inventory 145 units@ $7.00 $1,015 Jan. 10 Sales 1e5 units $16.ee Jan. 20 Purchase 70 unitse $6.ee 420 Jan. 25 Sales 85 units $26.00 Jan 10 Purchase 190 units $5.50 - 1.045 Totals 405 units $2,480 190 units The Company uses a perpetual Inventory system. For specific idenufication, ending inventory consists of 215 units, where 190 are from the January 30 purchase. 5 are from the January 20 purchase, and 20 are from beginning inventory Required: 1. Complete comparative Income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $1.300, and that the applicable income tax rate is 40% (Round your intermediate calculations to 2 decimal places. Sales Cost of goods sold Grossrolt LAKER COMPANY Income Statements For Month Ended January 31 Specific Weighted Identification Average FIFO LIFO 9 3.0403 364030485 3.840 120 1.775 1.764 1750 7040 1,360 1360 450 17 TO 30 E 3 2013 27 balores Netico D a Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts