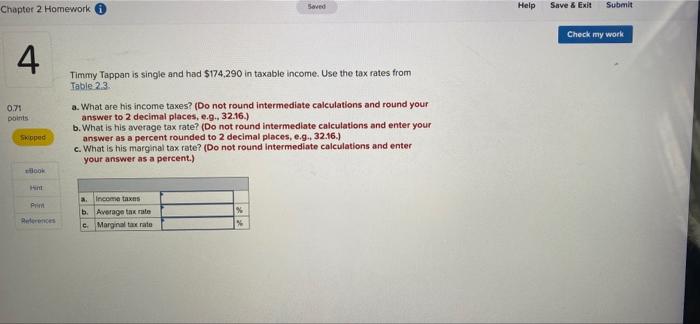

Question: Saved Chapter 2 Homework Help Save & Exit Submit Check my work 4 07: Dois Timmy Tappan is single and had $174.290 in taxable income.

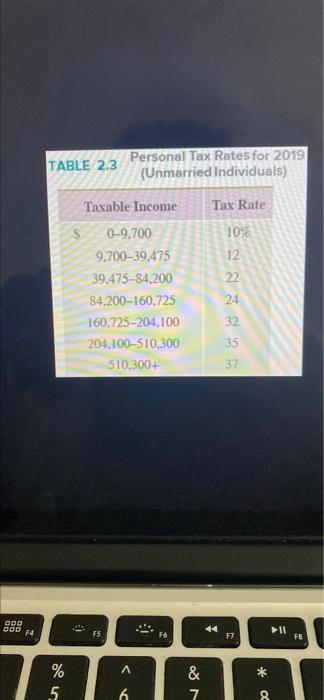

Saved Chapter 2 Homework Help Save & Exit Submit Check my work 4 07: Dois Timmy Tappan is single and had $174.290 in taxable income. Use the tax rates from Table 2.3 a. What are his income taxes? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is his average tax rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) c. What is his marginal tax rate? (Do not round Intermediate calculations and enter your answer as a percent.) Soped ook Hin Prim a. Income taxes b. Average tax rate c. Marginal tax rate % TABLE 2.3 Personal Tax Rates for 2019 (Unmarried Individuals) Taxable Income Tax Rate 10% 12 22 0-9.700 9,700-39,475 39.475-84.200 84.200-160,725 160.725-204,100 204.100-510.300 510,300+ 24 32 35 37 000 000 74 FS II F6 F2 FB A * % 5 ON & 7 6 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts