Question: Saved Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion

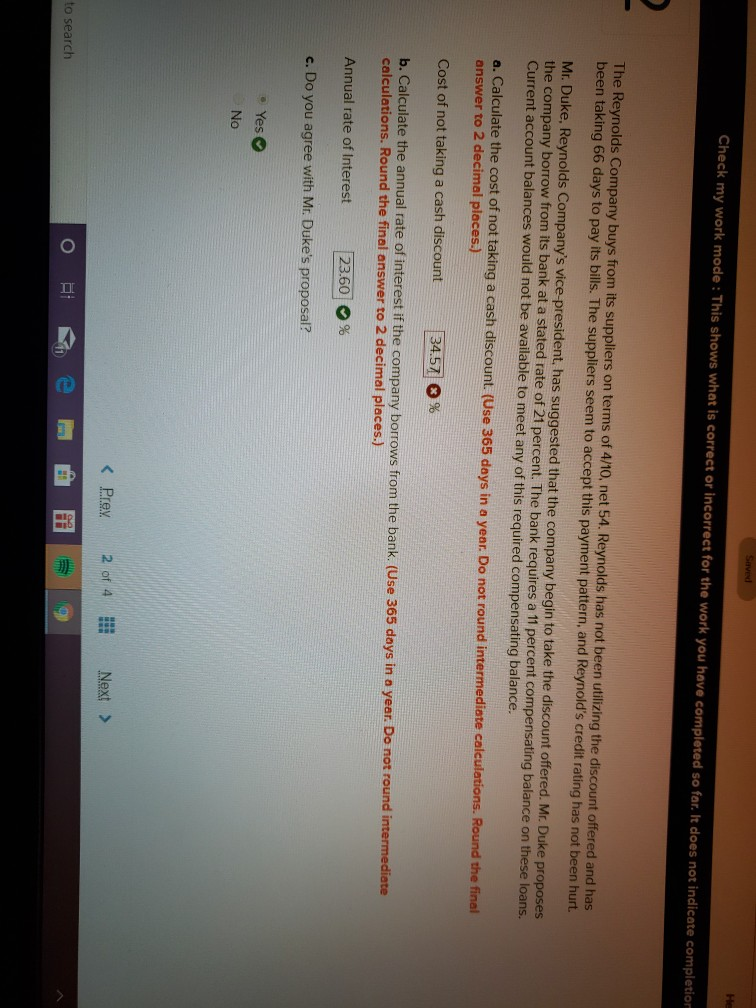

Saved Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion The Reynolds Company buys from its suppliers on terms of 4/10, net 54. Reynolds has not been utilizing the discount offered and has been taking 66 days to pay its bills. The suppliers seem to accept this payment pattern, and Reynold's credit rating has not been hurt. Mr. Duke, Reynolds Company's vice-president, has suggested that the company begin to take the discount offered. Mr. Duke proposes the company borrow from its bank at a stated rate of 21 percent. The bank requires a 11 percent compensating balance on these loans. Current account balances would not be available to meet any of this required compensating balance. a. Calculate the cost of not taking a cash discount. (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to 2 decimal places.) Cost of not taking a cash discount 34.57 % b. Calculate the annual rate of interest if the company borrows from the bank. (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to 2 decimal places.) Annual rate of Interest 23.60 % c. Do you agree with Mr. Duke's proposal? Yes No to search 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts