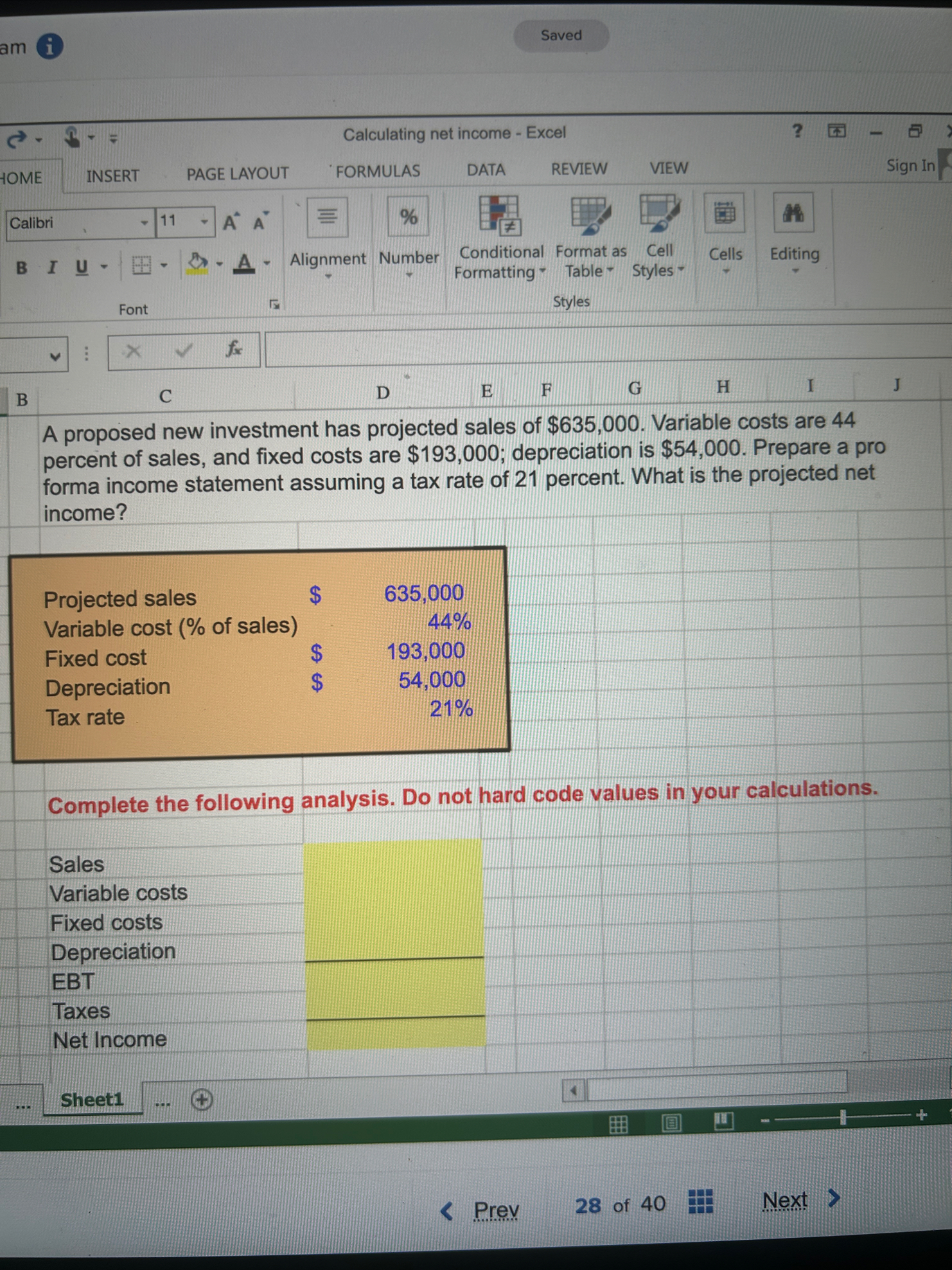

Question: Saved Complete the following analysis. Do not hard code values in your calculations. Sales Variable costs Fixed costs Depreciation EBT Taxes Net Income Sheet 1

Saved

Complete the following analysis. Do not hard code values in your calculations.

Sales

Variable costs

Fixed costs

Depreciation

EBT

Taxes

Net Income

Sheet

Prev

of

Next

Exam i

Calculating aftertax salvage value Excel

Sign In

HOME

INSERT

PAGE LAYOUT

FORMULAS

DATA

REVIEW

VIEW

Calibri

B I

U

A

Alignment

Number

Conditional Format as

Cell

Formatting Table Styles

Cells

Editing

Font

Styles

B

C

D

E

F

G

H

I

J

Consider an asset that costs $ and is depreciated straightline to zero over its eightyear tax life. The asset is to be used in a fiveyear project; at the end of the project, the asset can be sold for $ If the relevant tax rate is percent, what is the aftertax cash flow from the sale of this asset?

tableCosts$Pretax salvage value,$Tax rate,Years for depreciation,,Year asset is sold,,

Complete the following analysis. Do not hard code values in your calculations.

Annual depreciation

Accumulated depreciation

Book value

Sheet

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock