Question: Saved Help Save - 0 Joanette, Inc., is considering the purchase of a machine that would cost $530,000 and would last for 6 years, at

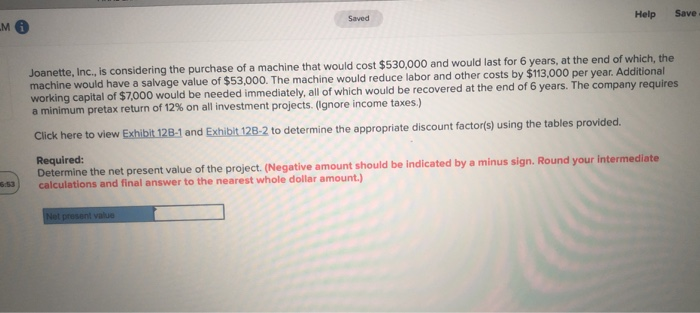

Saved Help Save - 0 Joanette, Inc., is considering the purchase of a machine that would cost $530,000 and would last for 6 years, at the end of which, the machine would have a salvage value of $53,000. The machine would reduce labor and other costs by $113,000 per year. Additional working capital of $7,000 would be needed immediately, all of which would be recovered at the end of 6 years. The company requires a minimum pretax return of 12% on all investment projects. (Ignore income taxes.) Click here to view Exhibit 128-1 and Exhibit 128-2 to determine the appropriate discount factor(s) using the tables provided. Required: Determine the net present value of the project. (Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to the nearest whole dollar amount.) Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts