Question: Saved Help Save & Ex Required information Problem 5-56 (LO 5-2) (Algo) [The following information applies to the questions displayed below.) Ricky received $8,520 of

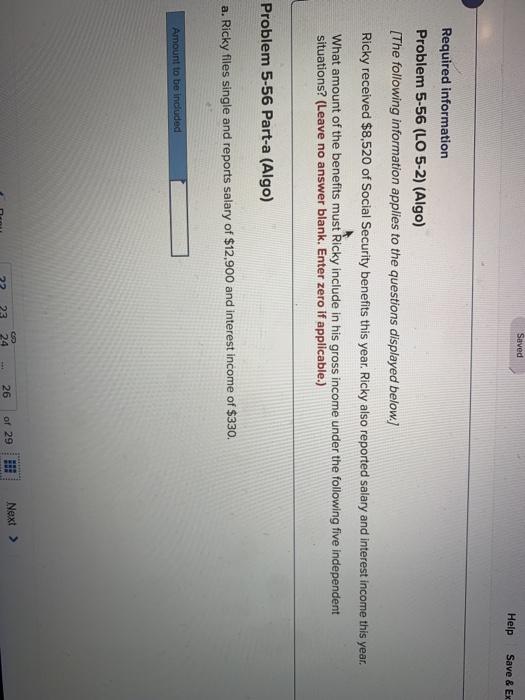

Saved Help Save & Ex Required information Problem 5-56 (LO 5-2) (Algo) [The following information applies to the questions displayed below.) Ricky received $8,520 of Social Security benefits this year. Ricky also reported salary and interest income this year. What amount of the benefits must Ricky include in his gross income under the following five independent situations? (Leave no answer blank. Enter zero if applicable.) Problem 5-56 Part-a (Algo) a. Ricky files single and reports salary of $12,900 and interest income of $330. Amount to be included 22 24 26 Next > -- of 29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts