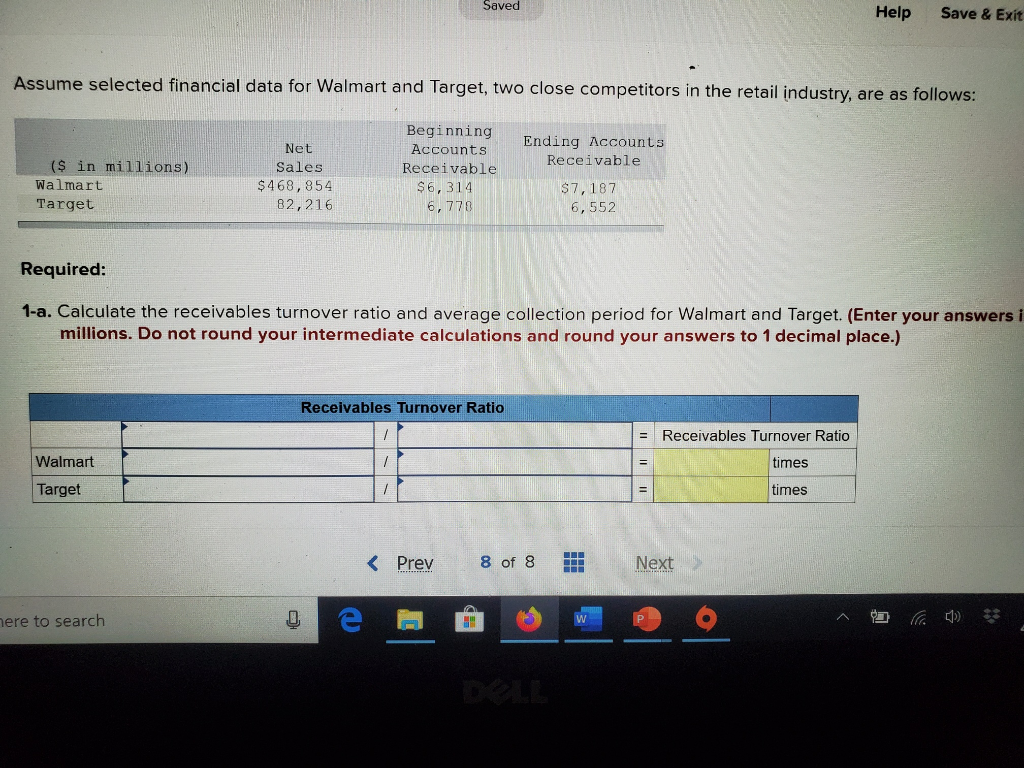

Question: Saved Help Save & Exit Assume selected financial data for Walmart and Target, two close competitors in the retail industry, are as follows: ($ in

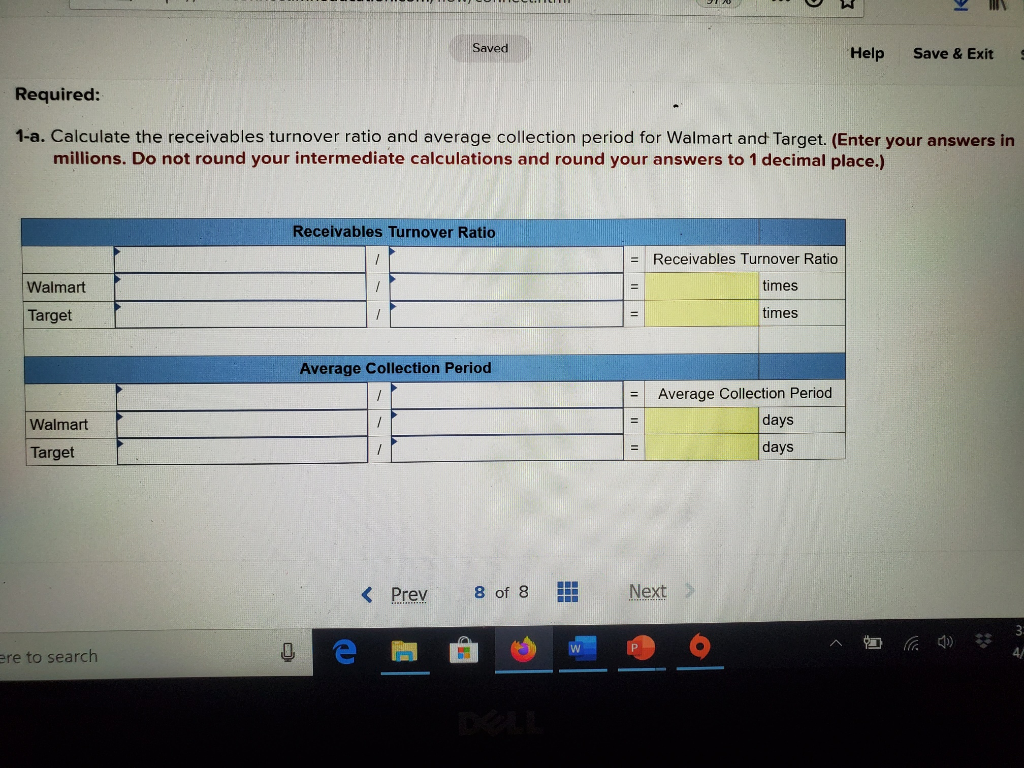

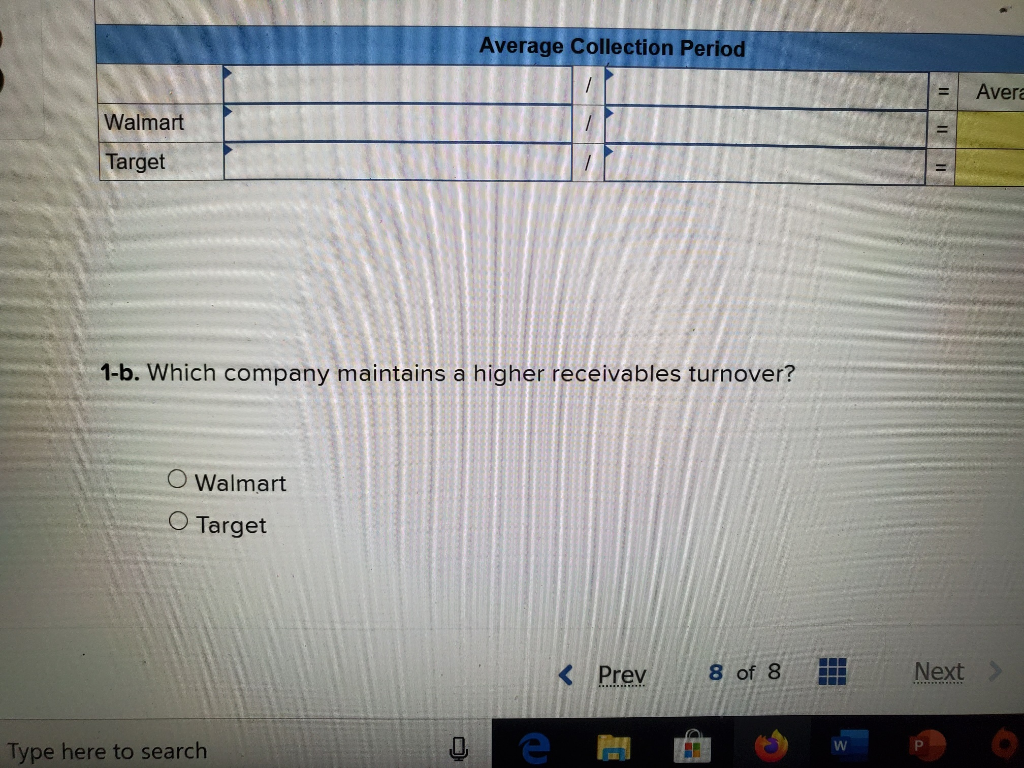

Saved Help Save & Exit Assume selected financial data for Walmart and Target, two close competitors in the retail industry, are as follows: ($ in millions) Walmart Target Net Sales $468,854 82,216 Beginning Accounts Receivable $6,314 6,778 Ending Accounts Receivable $7,187 6,552 Required: 1-a. Calculate the receivables turnover ratio and average collection period for Walmart and Target. (Enter your answers i millions. Do not round your intermediate calculations and round your answers to 1 decimal place.) Receivables Turnover Ratio Receivables Turnover Ratio times Walmart Target times here to search Saved Help Save & Exit Required: 1-a. Calculate the receivables turnover ratio and average collection period for Walmart and Target. (Enter your answers in millions. Do not round your intermediate calculations and round your answers to 1 decimal place.) Receivables Turnover Ratio Receivables Turnover Ratio times Walmart Target times Average Collection Period Walmart Target Average Collection Period days days ere to search w P Average Collection Period Aver Walmart TI Target 1-b. Which company maintains a higher receivables turnover? O Walmart O Target Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts