Question: Saved Help Save & Exit Required information [The following information applies to the questions displayed below.] The stockholders' equity of TVX Company at the beginning

![to the questions displayed below.] The stockholders' equity of TVX Company at](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e66d34b160e_26866e66d340784d.jpg)

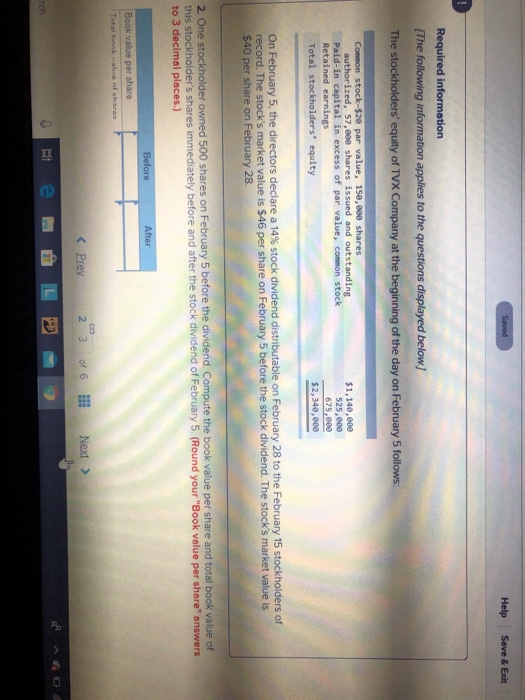

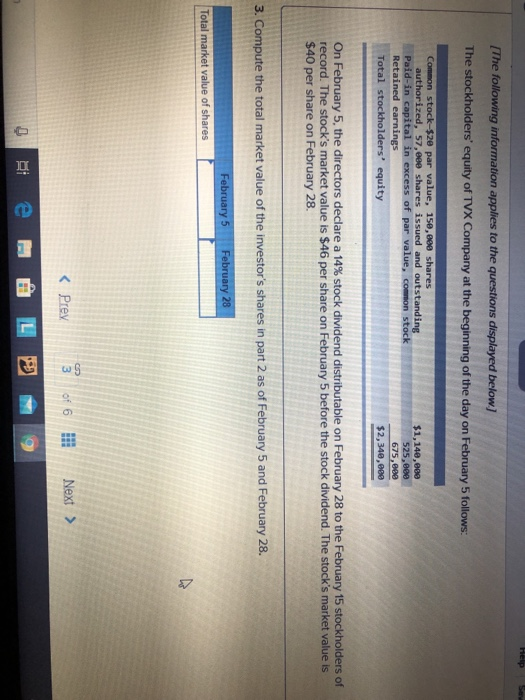

Saved Help Save & Exit Required information [The following information applies to the questions displayed below.] The stockholders' equity of TVX Company at the beginning of the day on February 5 follows: Common stock-$20 par value, 150,000 shares authorized, 57,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $1,140,000 525, eee 675,000 52,340,000 On February 5, the directors declare a 14% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $46 per share on February 5 before the stock dividend. The stock's market value is $40 per share on February 28 2. One stockholder owned 500 shares on February 5 before the dividend. Compute the book value per share and total book value of this stockholder's shares immediately before and after the stock dividend of February 5 (Round your "Book value per share" answers to 3 decimal places.) Before After Book value per share Total hand value of charos PAGD rch Help Save & Exit Sul common stock-$20 par value, 150,00 shares authorized, 57,shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $1,140,00 525,00 $2,140,000 On February 5, the directors declare a 14% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $46 per share on February 5 before the stock dividend. The stock's market value is $40 per share on February 28. 2. One stockholder owned 500 shares on February 5 before the dividend. Compute the book value per share and total book value of this stockholder's shares immediately before and after the stock dividend of February 5. (Round your "Book value per share" answers to 3 decimal places.) Before After Book value per share Total book value of shares arch [The following information applies to the questions displayed below) The stockholders' equity of TVX Company at the beginning of the day on February 5 follows: Common stock-ze par value, 150,00 shares authorized, 57, eee shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $1,140,000 525,000 675,000 $2,340,880 On February 5, the directors declare a 14% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $46 per share on February 5 before the stock dividend. The stock's market value is $40 per share on February 28. 3. Compute the total market value of the investor's shares in part 2 as of February 5 and February 28. February 5 February 28 Total market value of shares 0 te LDM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts