Question: Saved Help Save & Exit S A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a

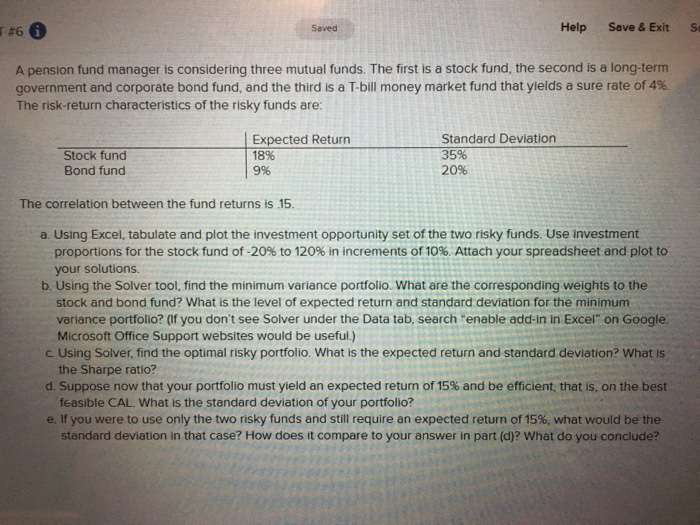

Saved Help Save & Exit S A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a T-bill money market fund that yields a sure rate of 4%. The risk-return characteristics of the risky funds are: Stock fund Bond fund Expected Return 18% Standard Deviation 35% 20% 9% The correlation between the fund returns is 15 a. Using Excel, tabulate and plot the investment opportunity set of the two risky funds. Use investment proportions for the stock fund of-20% to 120% in increments of 10%. Attach your spreadsheet and plot to your solutions. b. Using the Solver tool, find the minimum variance portfolio. What are the corresponding weights to the stock and bond fund? What is the level of expected return and standard deviation for the minimum variance portfolio? (If you don't see Solver under the Data tab, search enable add-in in Excel on Google Microsoft Office Support websites would be useful.) c. Using Solver, find the optimal risky portfolio. What is the expected return and standard deviation? What is d. Suppose now that your portfolio must yield an expected return of 15% and be efficient, that is, on the best e. If you were to use only the two risky funds and still require an expected return of 15%, what would be the the Sharpe ratio? feasible CAL. What is the standard deviation of your portfolio? standard deviation in that case? How does it compare to your answer in part (d)? What do you conclude

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts