Question: Saved Help Save & Exit s Delia Landscaping is considering a new 4-year project. The necessary fixed assets will cost $179,000 and be depreciated on

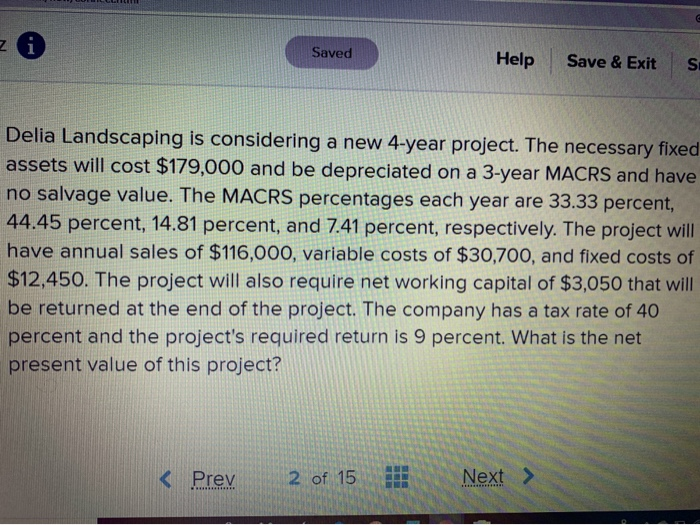

Saved Help Save & Exit s Delia Landscaping is considering a new 4-year project. The necessary fixed assets will cost $179,000 and be depreciated on a 3-year MACRS and have no salvage value. The MACRS percentages each year are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. The project will have annual sales of $116,000, variable costs of $30,700, and fixed costs of $12,450. The project will also require net working capital of $3,050 that will be returned at the end of the project. The company has a tax rate of 40 percent and the project's required return is 9 percent. What is the net present value of this project?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts