Question: Saved Help Save & Exit Su A company has outstanding 10.50 million shares of $2.50 par common stock and 11 million shares of $4.10 par

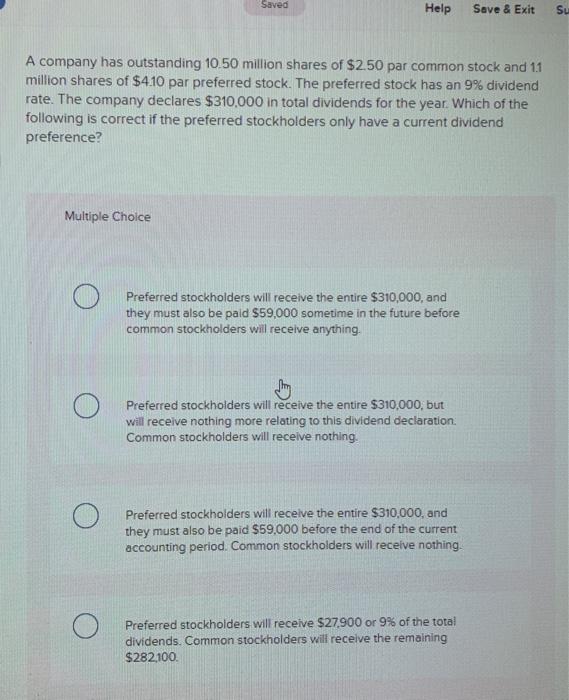

Saved Help Save & Exit Su A company has outstanding 10.50 million shares of $2.50 par common stock and 11 million shares of $4.10 par preferred stock. The preferred stock has an 9% dividend rate. The company declares $310,000 in total dividends for the year. Which of the following is correct if the preferred stockholders only have a current dividend preference? Multiple Choice Preferred stockholders will receive the entire $310,000, and they must also be paid $59,000 sometime in the future before common stockholders will receive anything Preferred stockholders will receive the entire $310,000, but will receive nothing more relating to this dividend declaration Common stoc lders will receive nothing. Preferred stockholders will receive the entire $310,000, and they must also be paid $59,000 before the end of the current accounting period. Common stockholders will receive nothing. Preferred stockholders will receive $27.900 or 9% of the total dividends. Common stockholders will receive the remaining $282,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts