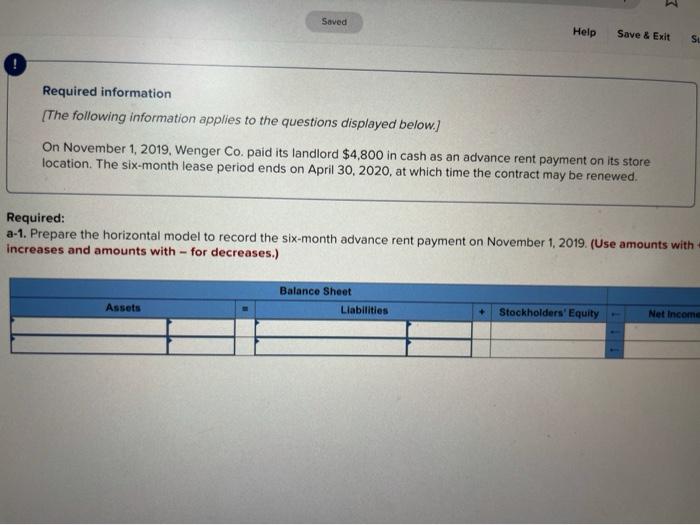

Question: Saved Help Save & Exit SU Required information [The following information applies to the questions displayed below.) On November 1, 2019, Wenger Co. paid its

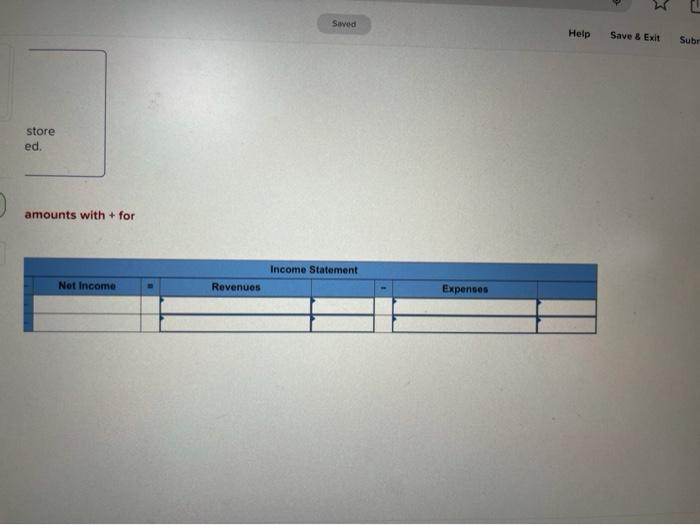

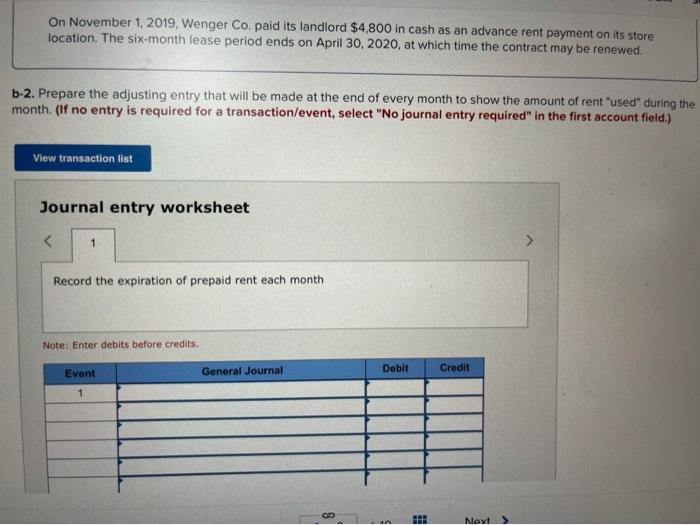

Saved Help Save & Exit SU Required information [The following information applies to the questions displayed below.) On November 1, 2019, Wenger Co. paid its landlord $4,800 in cash as an advance rent payment on its store location. The six-month lease period ends on April 30, 2020, at which time the contract may be renewed. Required: a-1. Prepare the horizontal model to record the six-month advance rent payment on November 1, 2019. (Use amounts with increases and amounts with - for decreases.) Balance Sheet Liabilities Assets Stockholders' Equity Net Income Saved Help Save & Exit Subr store ed, amounts with + for Income Statement Net Income Revenues Expenses On November 1, 2019, Wenger Co. paid its landlord $4,800 in cash as an advance rent payment on its store location. The six-month lease period ends on April 30, 2020, at which time the contract may be renewed. b-2. Prepare the adjusting entry that will be made at the end of every month to show the amount of rent "used" during the month. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 Record the expiration of prepaid rent each month Note: Enter debits before credits. Event General Journal Debit Credit 1 Nevt >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts