Question: Saved Help Save & Exit Submi Consider a 5 - year $ 1 , 0 0 0 face value note that has a 5 .

Saved

Help

Save & Exit

Submi

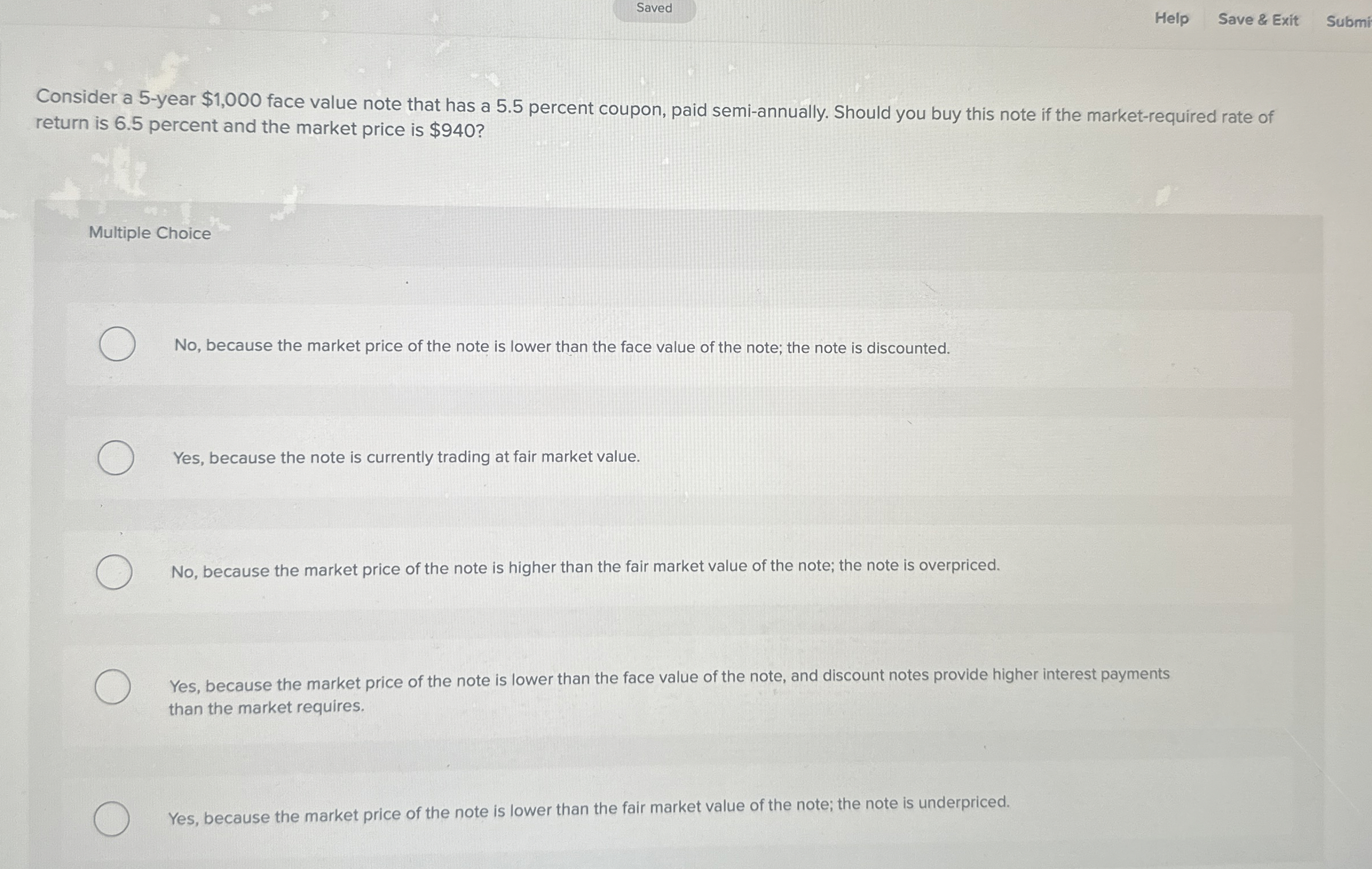

Consider a year $ face value note that has a percent coupon, paid semiannually. Should you buy this note if the marketrequired rate of return is percent and the market price is $

Multiple Choice

No because the market price of the note is lower than the face value of the note; the note is discounted.

Yes, because the note is currently trading at fair market value.

No because the market price of the note is higher than the fair market value of the note; the note is overpriced.

Yes, because the market price of the note is lower than the face value of the note, and discount notes provide higher interest payments than the market requires.

Yes, because the market price of the note is lower than the fair market value of the note; the note is underpriced.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock