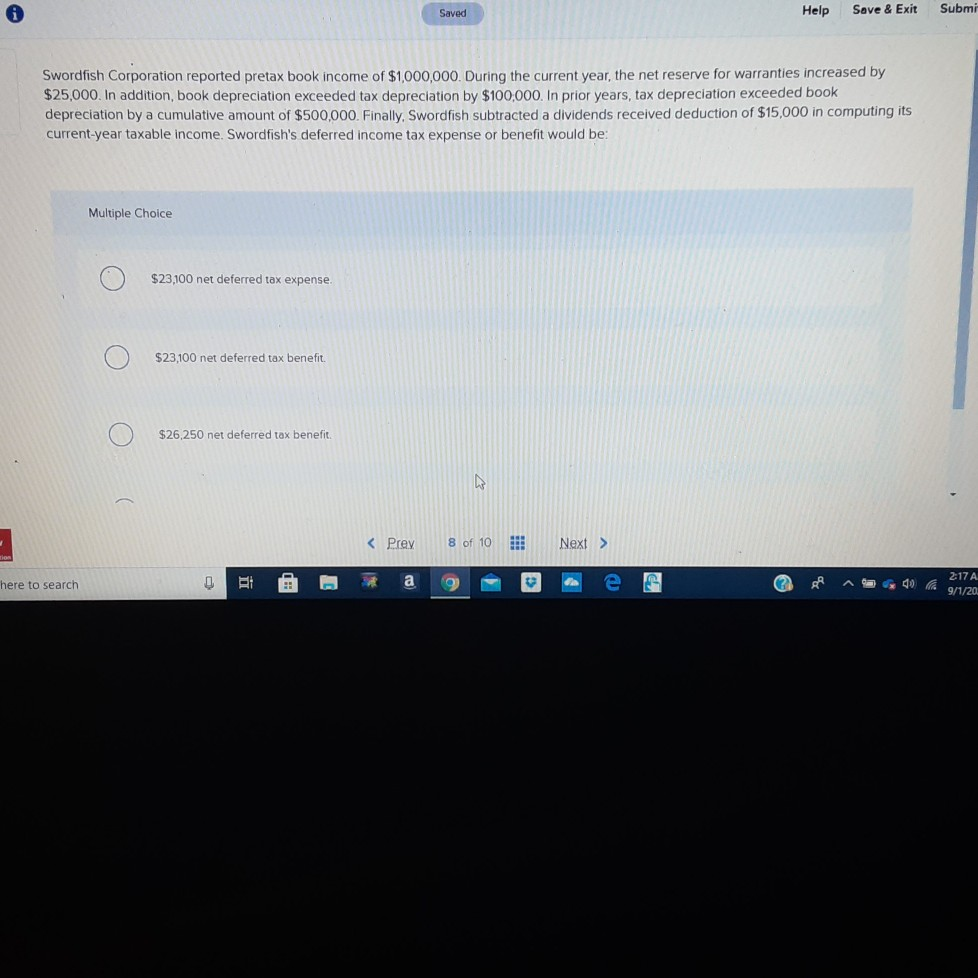

Question: Saved Help Save & Exit Submi Swordfish Corporation reported pretax book income of $1,000,000. During the current year, the net reserve for warranties increased by

Saved Help Save & Exit Submi Swordfish Corporation reported pretax book income of $1,000,000. During the current year, the net reserve for warranties increased by $25,000. In addition, book depreciation exceeded tax depreciation by $100,000. In prior years, tax depreciation exceeded book depreciation by a cumulative amount of $500,000. Finally, Swordfish subtracted a dividends received deduction of $15,000 in computing its current-year taxable income. Swordfish's deferred income tax expense or benefit would be: Multiple Choice $23,100 net deferred tax expense. $23.100 net deferred tax benefit. $26,250 net deferred tax benefit here to search i a - 3 000 2:17A 9/1/20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts