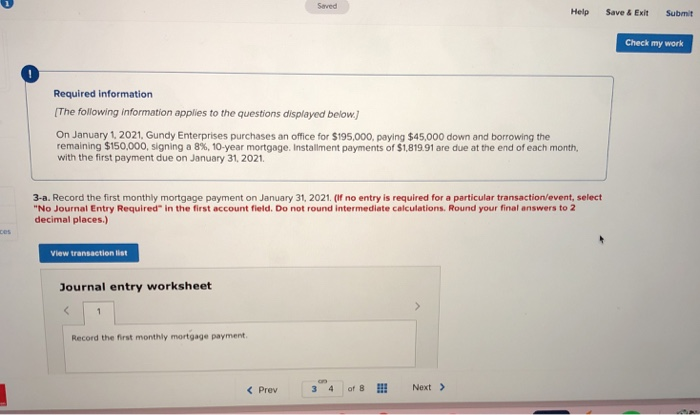

Question: Saved Help Save& Exit Submit Check my work Required information The following information applies to the questions displayed below On January 12021, Gundy Enterprises purchases

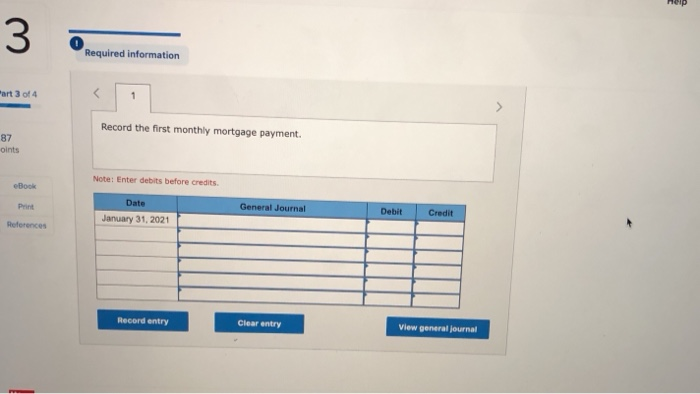

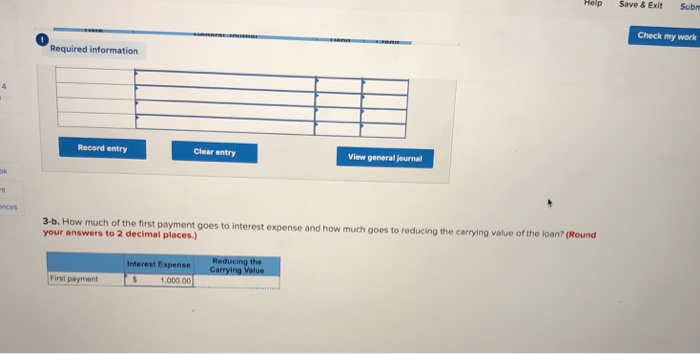

Saved Help Save& Exit Submit Check my work Required information The following information applies to the questions displayed below On January 12021, Gundy Enterprises purchases an office for $195,000, paying $45,000 down and borrowing the remaining $150,000, signing a 8%, 10-year mortgage. Installment payments of $1,81991 are due at the end of each month with the first payment due on January 31, 2021. 3-a. Record the first monthly mortgage payment on January 31, 2021. (If no entry is required for a particular transaction/event, select No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your final answers to 2 decimal places) View transaction list Journal entry worksheet Record the first monthly mortgage payment 0 Required information art 3 of 4 Record the first monthly mortgage payment 87 oints Note: Enter debits before credits eBook Print References Date General Journal Debit Credit January 31, 2021 Record entry Clear entry View general journal Help Save&Exit Subm Check my work 0 Required information Record entry Clear entry View general journal 3-b. How much of the first payment goes to interest expense your answers to 2 decimal places) Interest Expense c First payment 1,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts