Question: Saved Help Save & Exit Submit Delivery Service Express (DSE) has a fleet of trucks and specializes in the delivery of refrigerated foods. The

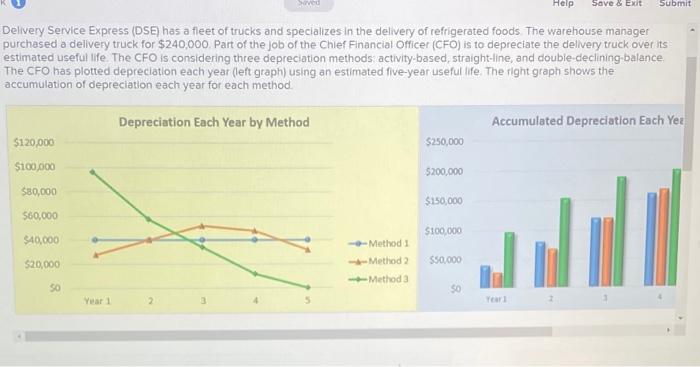

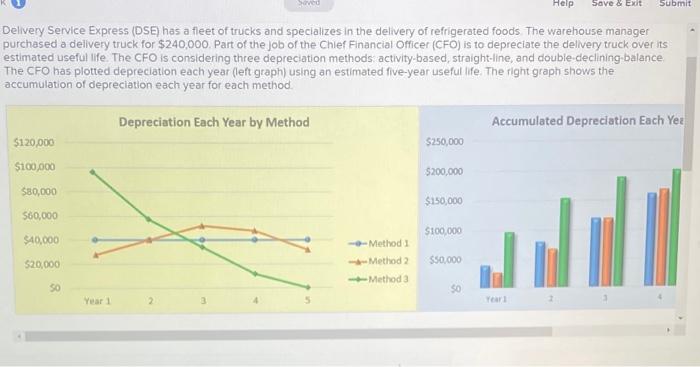

Saved Help Save & Exit Submit Delivery Service Express (DSE) has a fleet of trucks and specializes in the delivery of refrigerated foods. The warehouse manager purchased a delivery truck for $240,000. Part of the job of the Chief Financial Officer (CFO) is to depreciate the delivery truck over its estimated useful life. The CFO is considering three depreciation methods: activity-based, straight-line, and double-declining-balance The CFO has plotted depreciation each year (left graph) using an estimated five-year useful life. The right graph shows the accumulation of depreciation each year for each method. $120,000 $100,000 Depreciation Each Year by Method $80,000 $60,000 $40,000 $20,000 50 Year 1 2 Accumulated Depreciation Each Yea $250,000 $200,000 $150,000 $100,000 --Method 1 --Method 2 $50,000 Method 3 50 Year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts