Question: Saved Help Save & Exit Submit Information for two alternative projects involving machinery investments follows. Project 1 requires an initial investment of $128,100. Project 2

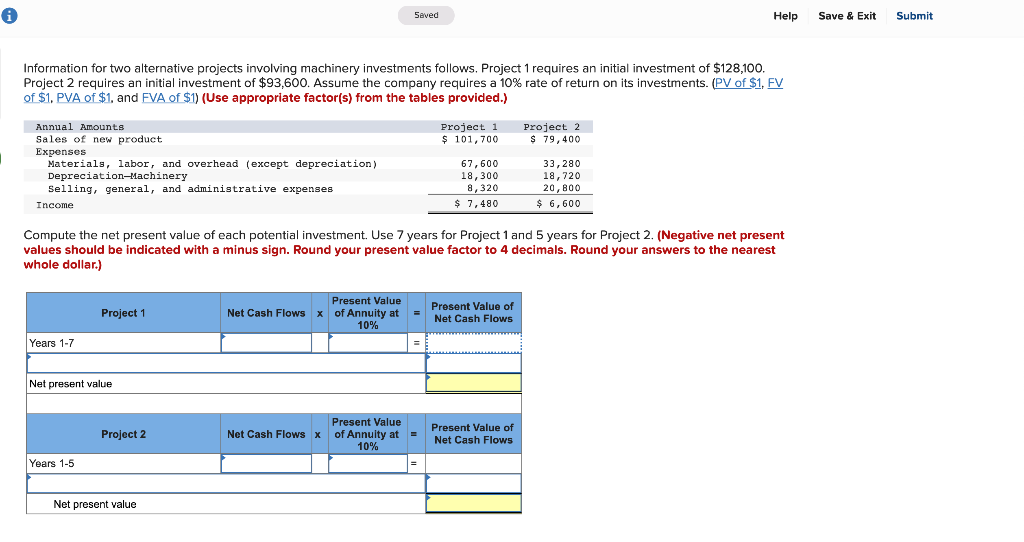

Saved Help Save & Exit Submit Information for two alternative projects involving machinery investments follows. Project 1 requires an initial investment of $128,100. Project 2 requires an initial investment of $93,600. Assume the company requires a 10% rate of return on its investments. (PV of $1. FV of $1. PVA of $1. and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project 1 $ 101, 700 Project 2 $ 79,400 Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation Machinery Selling, general, and administrative expenses Income 67,600 18,300 8,320 $ 7,480 33,280 18,720 20,800 $ 6,600 Compute the net present value of each potential investment. Use 7 years for Project 1 and 5 years for Project 2. (Negative net present values should be indicated with a minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar.) Project 1 Present Value Net Cash Flows x of Annuity at 10% Present Value of Net Cash Flows Years 1-7 Net present value Project 2 Present Value Net Cash Flows x of Annuity at X 10% Present Value of Net Cash Flows Years 1-5 Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts