Question: Saved Help Save & Exit Submit On January 1, 2018, Alamar Corporation acquired a 38 percent interest in Burks, Inc., for $233,000. On that date,

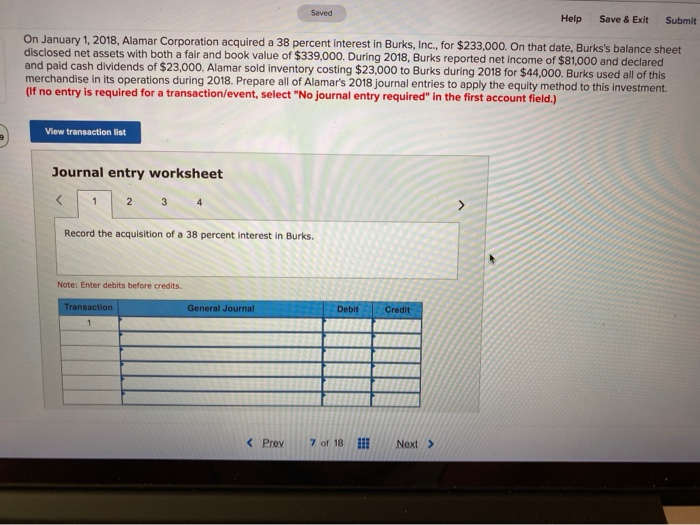

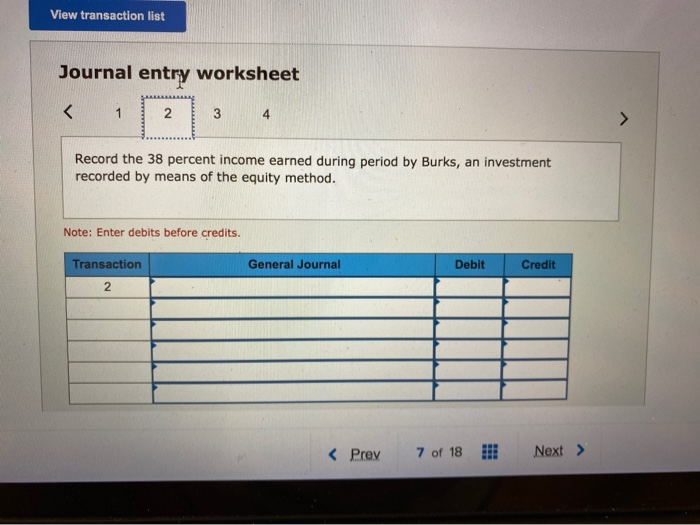

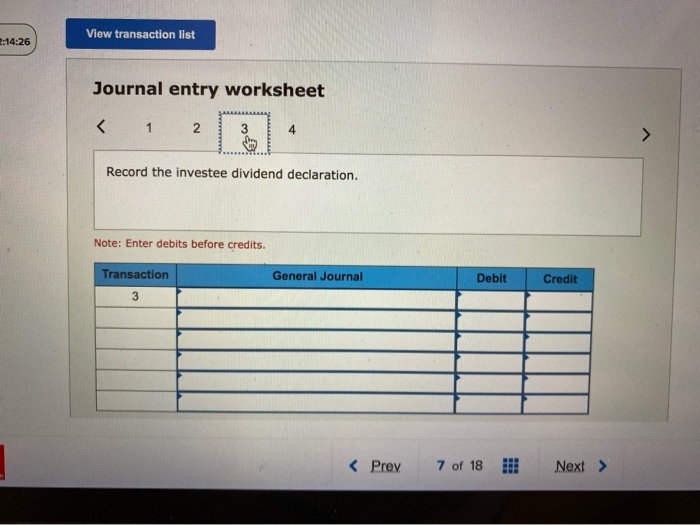

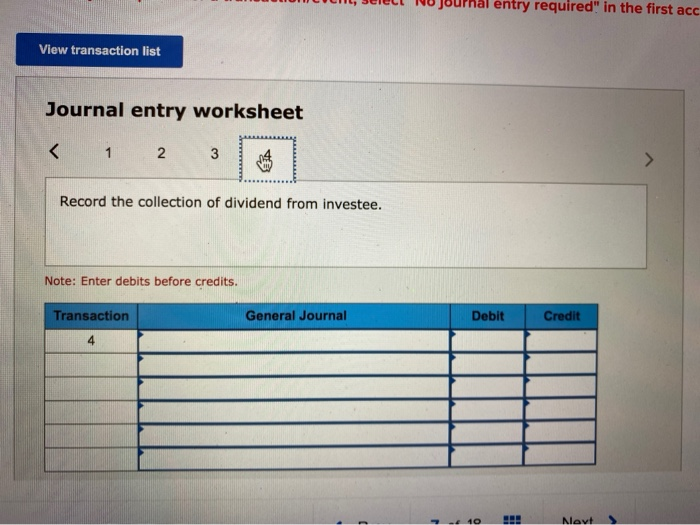

Saved Help Save & Exit Submit On January 1, 2018, Alamar Corporation acquired a 38 percent interest in Burks, Inc., for $233,000. On that date, Burks's balance sheet disclosed net assets with both a fair and book value of $339,000. During 2018, Burks reported net income of $81,000 and declared and paid cash dividends of $23,000. Alamar sold inventory costing $23,000 to Burks during 2018 for $44,000. Burks used all of this merchandise in its operations during 2018. Prepare all of Alamar's 2018 journal entries to apply the equity method to this investment (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 Record the acquisition of a 38 percent interest in Burks. Note: Enter debits before credits Transaction General Journal Debit Credit 1 View transaction list Journal entry worksheet Record the 38 percent income earned during period by Burks, an investment recorded by means of the equity method. Note: Enter debits before credits. Transaction General Journal Debit Credit 2 View transaction list 2:14:26 Journal entry worksheet Record the investee dividend declaration. Note: Enter debits before credits. Transaction General Journal Debit Credit 3 entry required" in the first acc View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts