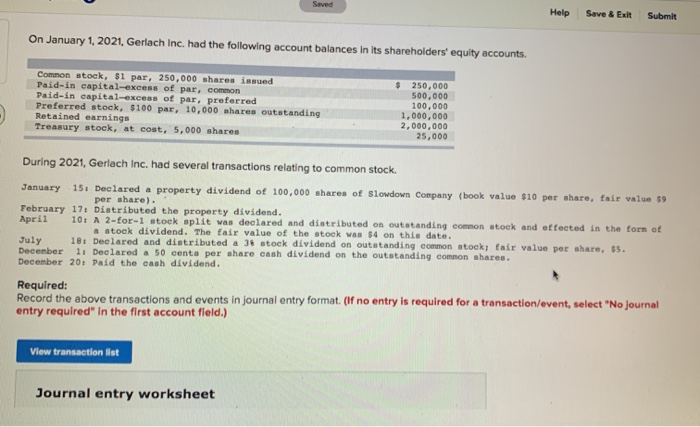

Question: Saved Help Save & Exit Submit On January 1, 2021, Gerlach Inc, had the following account balances in its shareholders' equity accounts Common stock, $1

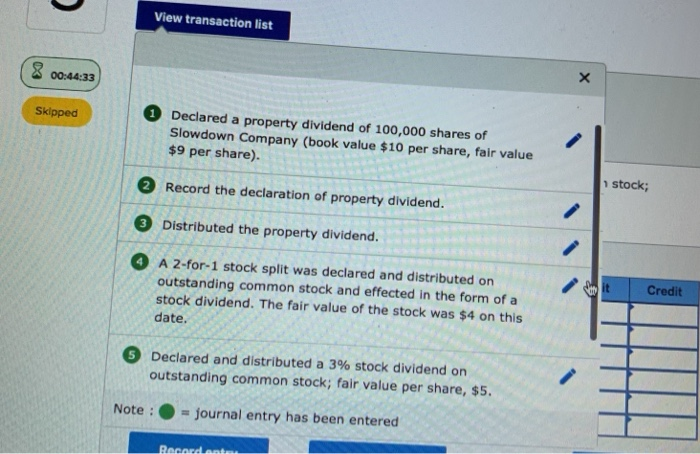

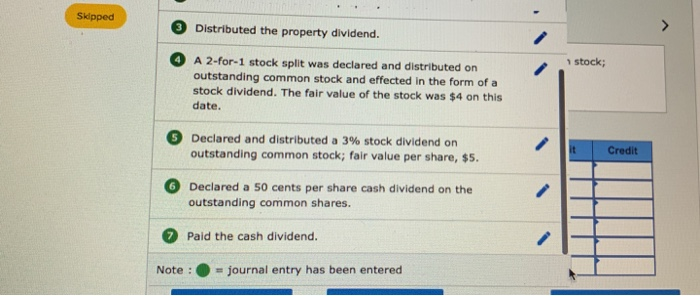

Saved Help Save & Exit Submit On January 1, 2021, Gerlach Inc, had the following account balances in its shareholders' equity accounts Common stock, $1 par, 250,000 shares issued Paid-in capital-excess of par, common Paid-in capital-excess of par, preferred Preferred stock, $100 par, 10.000 shares outstanding Retained earnings Treasury stock, at cost, 5.000 shares $ 250,000 500,000 100,000 1,000,000 2.000.000 25,000 During 2021, Gerlach Inc. had several transactions relating to common stock. January 15. Declared a property dividend of 100,000 shares of slowdown Company (book value $10 per share, fair value $9 per ghare). February 17. Distributed the property dividend. April 10: A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. The fair value of the stock was $4 on this date. July 18: Declared and distributed a 38 stock dividend on outstanding common stock: fair value per share, $5. December 1. Declared a 50 cents per share cash dividend on the outstanding common shares. December 20: Paid the cash dividend. Required: Record the above transactions and events in journal entry format. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.) View transaction list Journal entry worksheet View transaction list 8 00:44:33 Skipped Declared a property dividend of 100,000 shares of Slowdown Company (book value $10 per share, fair value $9 per share). Record the declaration of property dividend. 1 stock; 3 Distributed the property dividend. A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. The fair value of the stock was $4 on this date. Credit 5 Declared and distributed a 3% stock dividend on outstanding common stock; fair value per share, $5. Note : = journal entry has been entered Recordanti Skipped 3 Distributed the property dividend. O stock; A 2-for-1 stock split was declared and distributed on outstanding common stock and effected in the form of a stock dividend. The fair value of the stock was $4 on this date. S Declared and distributed a 3% stock dividend on outstanding common stock; fair value per share, $5. Credit 6 Declared a 50 cents per share cash dividend on the outstanding common shares. Paid the cash dividend. Note : = journal entry has been entered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts