Question: Saved Help Save & Exit Submit Required information (The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security

![applies to the questions displayed below.] BMX Company has one employee. FICA](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66dfff98db53c_99266dfff983cf7b.jpg)

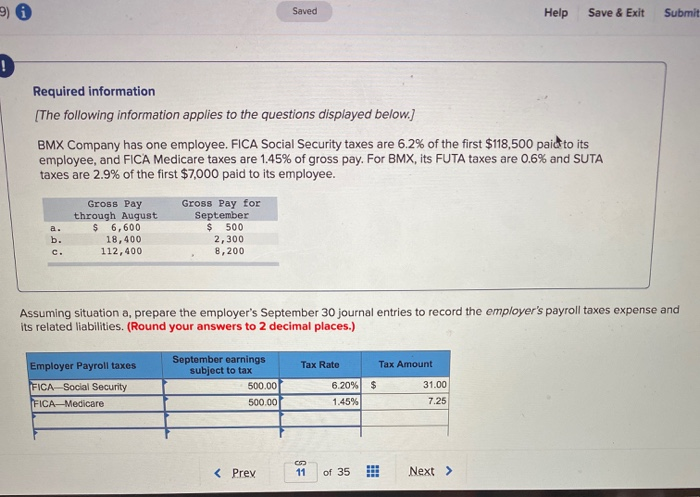

Saved Help Save & Exit Submit Required information (The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $118,500 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 2.9% of the first $7,000 paid to its employee. Gross Pay through August $ 6,600 18,400 112,400 Gross Pay for September $ 500 2,300 8,200 Assuming situation a, prepare the employer's September 30 journal entries to record the employer's payroll taxes expense and its related liabilities. (Round your answers to 2 decimal places.) Tax Rate Tax Amount Employer Payroll taxes FICA Social Security FICA-Medicare September earnings subject to tax 500.00 500.00 $ 6.20% 1.45% 31.00 7.25 Journal entry worksheet Record the employer's September 30 payroll taxes expense and its related liabilities. Note: Enter debits before credits. Date General Journal Debit Credit Sep 30 Record entry Clear entry View general Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts