Question: Saved Help Save & Exit Submit TipTop Flight School offers flying lessons at a small municipal airport. The school's owner and manager has been attempting

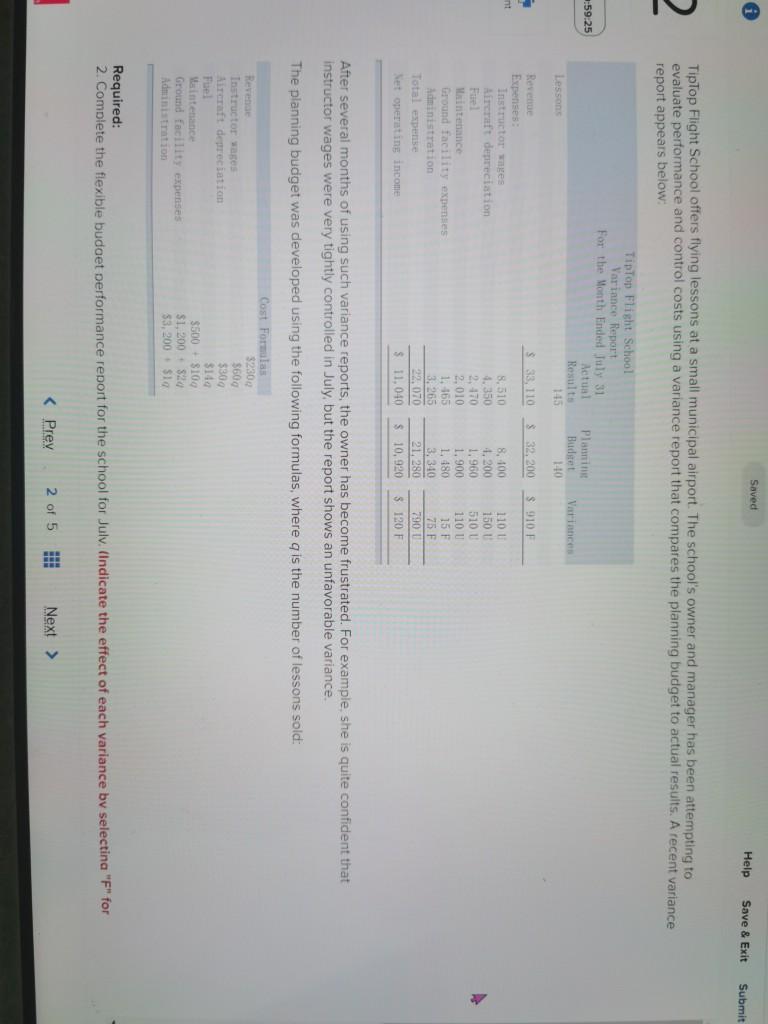

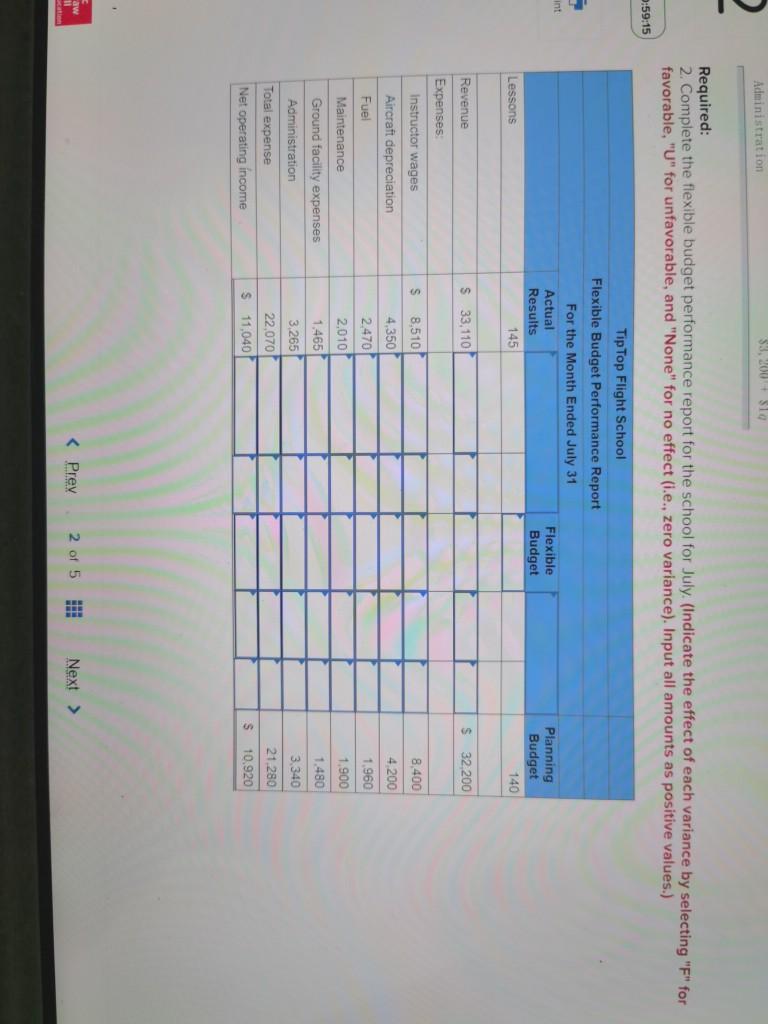

Saved Help Save & Exit Submit TipTop Flight School offers flying lessons at a small municipal airport. The school's owner and manager has been attempting to evaluate performance and control costs using a variance report that compares the planning budget to actual results. A recent variance report appears below: :59:25 TipTop Flight School Variance Report For the Month Ended July 31 Actual Results 115 Plan Budget 1440 Variances Lesson S33, 110 S32. 200 S 910 F nt Revenue Expenses Instructor waites Aircraft depreciation Fuel Maintenance Ground facility expenses Administration Total expense Set operating income 8,510 4.350 2,170 2,010 1. 165 3,265 22,070 $11.040 8,100 1,200 1.960 1. 900 1 480 1100 150 5101 110 15 F 75 F 790 1 3 120 F 3.340 21, 280 $ 10,920 After several months of using such variance reports, the owner has become frustrated. For example, she is quite confident that instructor wages were very tightly controlled in July, but the report shows an unfavorable variance The planning budget was developed using the following formulas, where is the number of lessons sold: Revenue Instructor was Aircraft dereciation Fuel intenance Ground facility expenses Administration Cost Formulas 3230 $600 $300 3146 $500 $100 SI, 200 - 320 53,200 $1 Required: 2. Complete the flexible budget performance report for the school for Julv. (Indicate the effect of each variance by selectina "F" for Administration $3,200+ $10 Required: 2. Complete the flexible budget performance report for the school for July (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) 0:59:15 Tip Top Flight School Flexible Budget Performance Report For the Month Ended July 31 Actual Results 145 int Flexible Budget Planning Budget 140 Lessons Revenue $ 33,110 $ 32 200 Expenses Instructor wages Aircraft depreciation $ 8.510 8,400 4,200 4.350 2.470 Fuel 1.960 Maintenance 2,010 1465 Ground facility expenses Administration 1.900 1.480 3,340 21.280 10.920 Total expense 3,265 22,070 $ 11,040 Net operating income S aw

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts