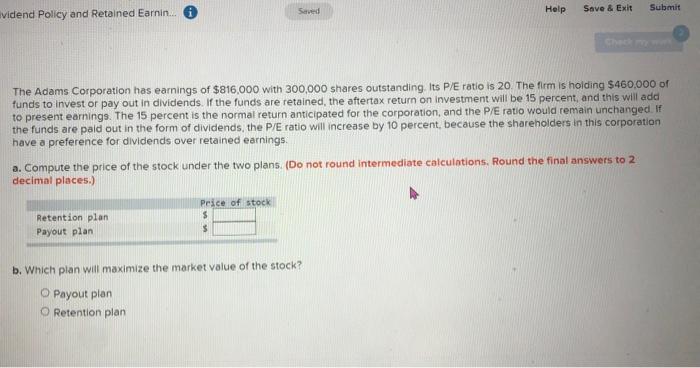

Question: Saved Help Save & Exit Submit vidend Policy and Retained Earnin... The Adams Corporation has earnings of $816,000 with 300,000 shares outstanding. Its P/E ratio

Saved Help Save & Exit Submit vidend Policy and Retained Earnin... The Adams Corporation has earnings of $816,000 with 300,000 shares outstanding. Its P/E ratio is 20 The flem is holding $460,000 of funds to invest or pay out in dividends. If the funds are retained, the aftertax return on investment will be 15 percent, and this will add to present earnings. The 15 percent is the normal return anticipated for the corporation, and the P/E ratio would remain unchanged. If the funds are paid out in the form of dividends, the P/E ratio will increase by 10 percent, because the shareholders in this corporation have a preference for dividends over retained earnings a. Compute the price of the stock under the two plans. (Do not round intermediate calculations. Round the final answers to 2 decimal places.) Retention plan Payout plan Price of stock $ $ b. Which plan will maximize the market value of the stock? O Payout plan O Retention plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts