Question: Saved Help Save & Exit Submit y work mode : This shows what is correct or incorrect for the work you have completed so far.

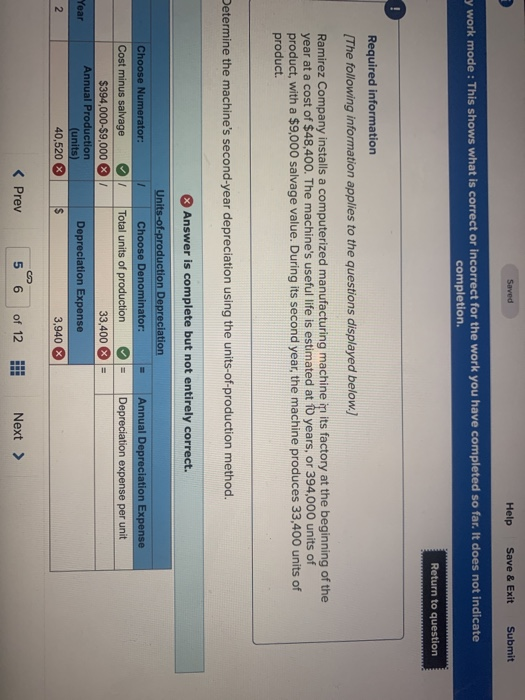

Saved Help Save & Exit Submit y work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question Required information (The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $48,400. The machine's useful life is estimated at 10 years, or 394,000 units of product, with a $9,000 salvage value. During its second year, the machine produces 33,400 units of product. Determine the machine's second-year depreciation using the units-of-production method. Answer is complete but not entirely correct. Annual Depreciation Expense Depreciation expense per unit Choose Numerator: Cost minus salvage $394,000-$9,000 Annual Production (units) 40,520 Units-of-production Depreciation Choose Denominator: Total units of production / 33,400 Depreciation Expense $ 3,940 - = Year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts