Question: Saved Help Save & Ext Submit Problem 1-42 (LO 1-3, LO 1-4) (Algo) Nancy invests $250,000 in a State of Jolly bond that pays 5.6

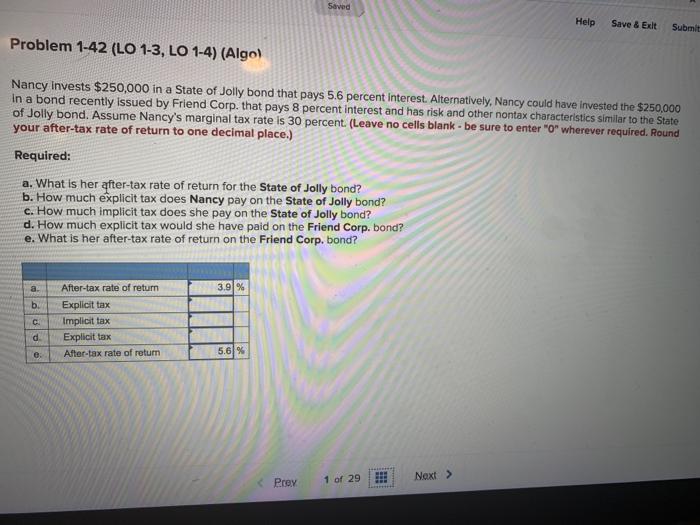

Saved Help Save & Ext Submit Problem 1-42 (LO 1-3, LO 1-4) (Algo) Nancy invests $250,000 in a State of Jolly bond that pays 5.6 percent interest. Alternatively, Nancy could have invested the $250,000 In a bond recently issued by Friend Corp. that pays 8 percent interest and has risk and other nontax characteristics similar to the State of Jolly bond. Assume Nancy's marginal tax rate is 30 percent. (Leave no cells blank - be sure to enter "o" wherever required. Round your after-tax rate of return to one decimal place.) Required: a. What is her after-tax rate of return for the State of Jolly bond? b. How much explicit tax does Nancy pay on the State of Jolly bond? c. How much implicit tax does she pay on the State of Jolly bond? d. How much explicit tax would she have paid on the Friend Corp. bond? e. What is her after-tax rate of return on the Friend Corp. bond? a 3.9% b. C d After-tax rate of return Explicit tax Implicit tax Explicit tax After-tax rate of return e 5.6% Prey 1 of 29 Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts