Question: Saved Help Save This question has multiple parts. You must answer all parts for full credit. Assume you decide to invest in a new point-of-sale

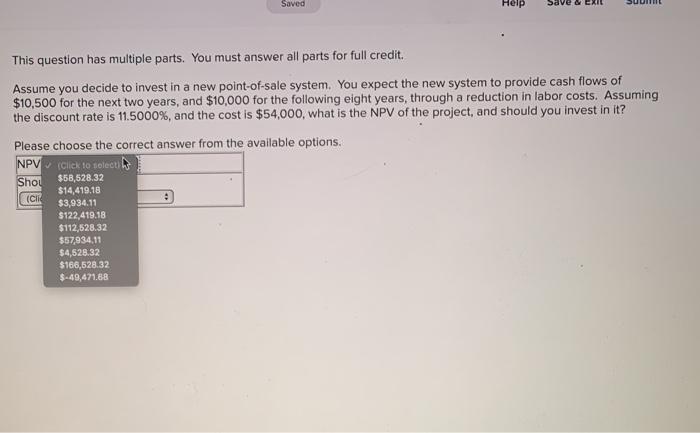

Saved Help Save This question has multiple parts. You must answer all parts for full credit. Assume you decide to invest in a new point-of-sale system. You expect the new system to provide cash flows of $10,500 for the next two years, and $10,000 for the following eight years, through a reduction in labor costs. Assuming the discount rate is 11.5000%, and the cost is $54,000, what is the NPV of the project, and should you invest in it? Please choose the correct answer from the available options. NPV (Click to select Shou $58,528.32 $14,419.18 $3,934.11 $122,419.18 $112,528.32 $57,934,11 $4,528.32 $166,528.32 $-49,471.68 (CIR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts