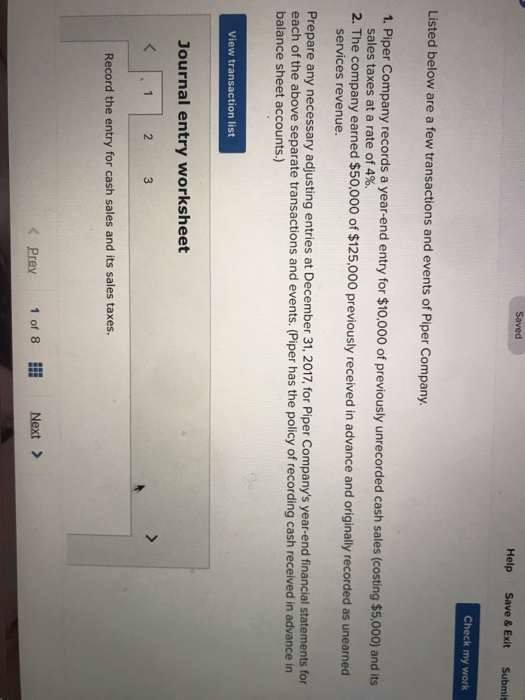

Question: Saved Help Save&ExitSubmit Check my work Listed below are a few transactions and events of Piper Company. 1. Piper Company records a year-end entry for

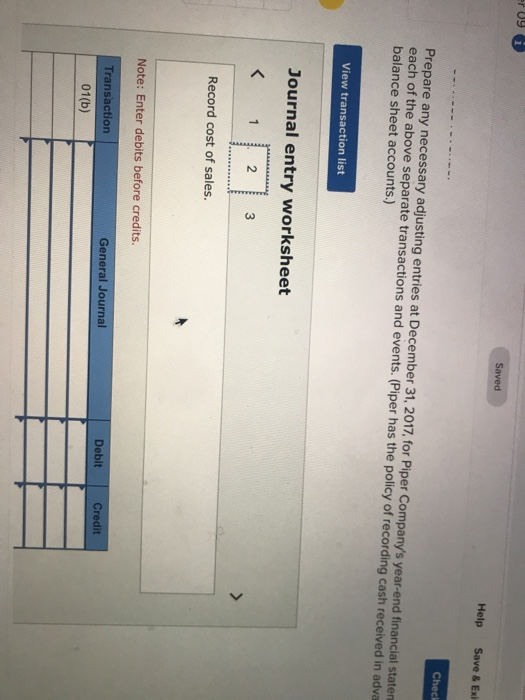

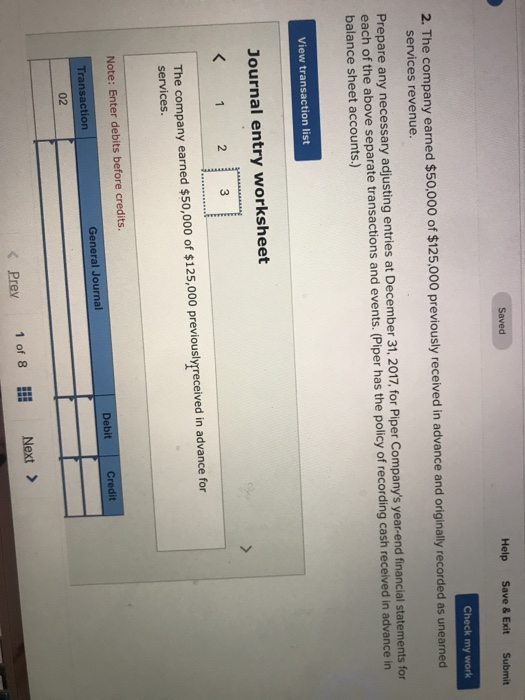

Saved Help Save&ExitSubmit Check my work Listed below are a few transactions and events of Piper Company. 1. Piper Company records a year-end entry for $10,000 of previously unrecorded cash sales (costing $5,000) and it sales taxes at a rate of 4%. 2. The company earned $50.000 of $125,000 previously received in advance and originally recorded as unearned services revenue Prepare any necessary adjusting entries at December 31, 2017, for Piper Company's year-end financial statements for each of the above separate transactions and events. (Piper has the policy of recording cash received in advance in balance sheet accounts.) View transaction list Journal entry worksheet Record the entry for cash sales and its sales taxes.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts