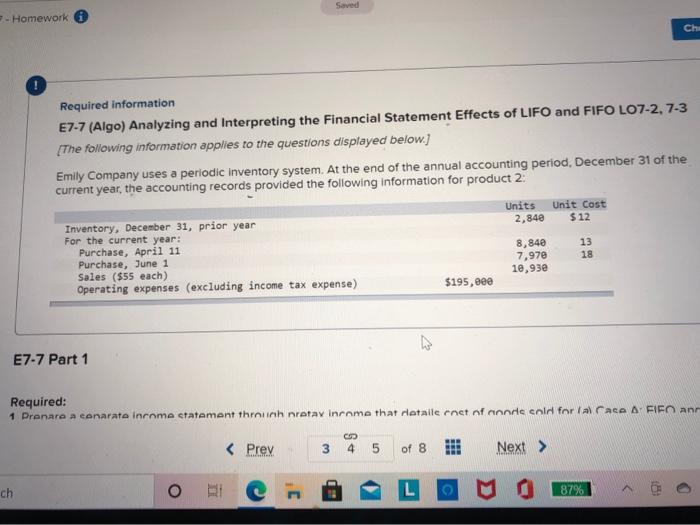

Question: Saved - Homework - Ch Required information E7-7 (Algo) Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO7-2, 7-3 [The following information

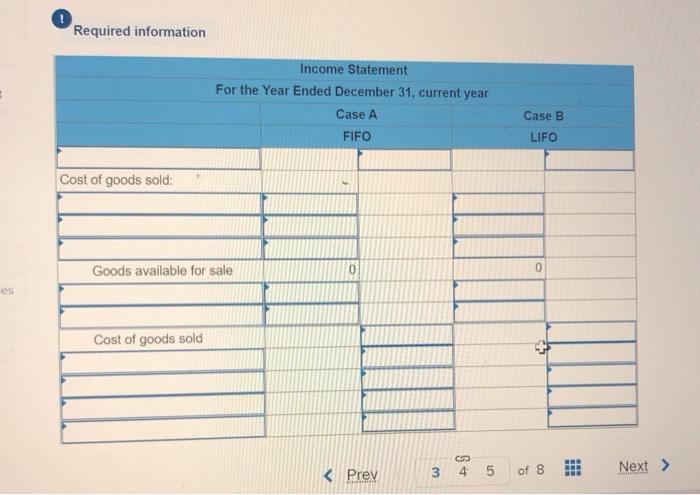

Saved - Homework - Ch Required information E7-7 (Algo) Analyzing and Interpreting the Financial Statement Effects of LIFO and FIFO LO7-2, 7-3 [The following information applies to the questions displayed below.) Emily Company uses a periodic Inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product 2: Units 2,840 Unit Cost $12 Inventory, December 31, prior year For the current year: Purchase, April 11 Purchase, June 1 Sales ($55 each) Operating expenses (excluding income tax expense) 8,840 7,970 10,93e 13 18 $195, eee E7-7 Part 1 Required: 1 Prenare a cenarate income statement throun netay income that detalle cnet nf noodle cold for a race A FIFO an ch L 87% D O Required information Income Statement For the Year Ended December 31, current year Case A Case B FIFO LIFO Cost of goods sold: Goods available for sale 0 0 es Cost of goods sold CO 3 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts